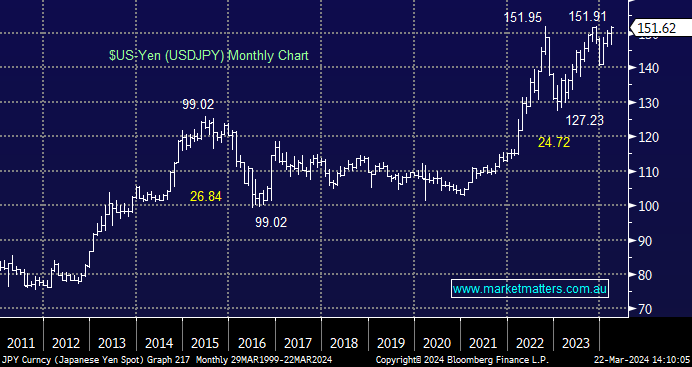

Thoughts on the USDJPY currency cross

Hi guys, I thought I'd throw you a currency question this week to keep you on your toes. I'll keep it short and sweet. USDJPY has behaved exactly opposite to what I thought it would, considering the end of negative rates I thought the Yen would've had a nice bullish run. When we also consider that the US is closer to rate cuts too, I find it strange. Can you give any reasons or explanation as to why? My only thoughts are it was the worst kept secret and it was already priced in, and/or, the market is pushing the Yen down to force a larger rate increase. FWIW; the temptation was to strong and I entered a sell position at 151.55 seeing the risk reward in my favour. Regards, Simon