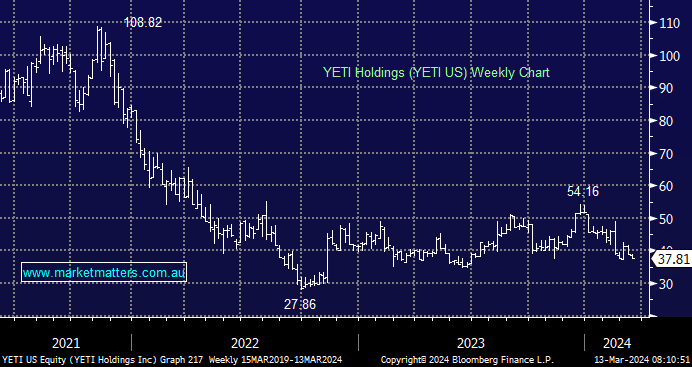

The outdoor product company, founded in 2006 and went public in October 2018, has three segments: Coolers & Equipment, Drinkware, and other, comprised of Outerwear & Gear. Everyone seems to love their products, and we certainly do, yet the stock is down ~20% since they reported Q4 earnings towards the end of February. This is a US business, which drives ~84% of its sales. However, they are expanding internationally, and that part now makes up ~16% of sales. You’ll notice YETI featured on the jersey of a North QLD Cowboys, highlighting Australia as a key growth market.

This consumer growth company has previously delivered double-digit sales growth over time. However, the top-line growth they’ve experienced in the US market has slowed, and their guidance for 24 implies that challenges remain. This is the main reason analysts, by and large, downgraded the stock following Q4 numbers, and while the consensus price target is still $43.71 (18 analysts cover it), expectations around a strong recovery this year have ‘cooled’. There are also some margin headwinds related to freight costs, and with sluggish sales growth meeting cost pressures, the outlook in the short term has become more muted.

- The question is whether or not this is now captured in the price. Earnings are still expected to rise an average of ~10% pa over the next three years, and on a 1-year forward PE of 15.19x, it feels cheap, especially compared to other fast-growing consumer stocks.

The share price is now back within ~3% of our buy level, and while we doubt there will be a recovery in the short term, we continue to like their medium-term prospects.