What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

In early February, one of the most dominating stories in the financial news was the plunging lithium price and demise of the related stocks. Less than 2-years ago, analysts were extrapolating huge demand for EVs over the decade ahead would continue to push the required materials, such as lithium, cobalt and nickel, ever higher, generating huge profits for the related miners, but as we now know, the demand for EVs has fallen short of estimates, especially in the influential US, which combined with increasing supply of lithium drove down prices over 80%, i.e. in this case making the market not wrong, but very wrong!

- Traders benefitted from the lithium demise by heavily shorting lithium-based stocks, such as Pilbara Minerals (PLS), Core Lithium (CXO), Sayona Mining (SYA), and Liontown Resources (LTR).

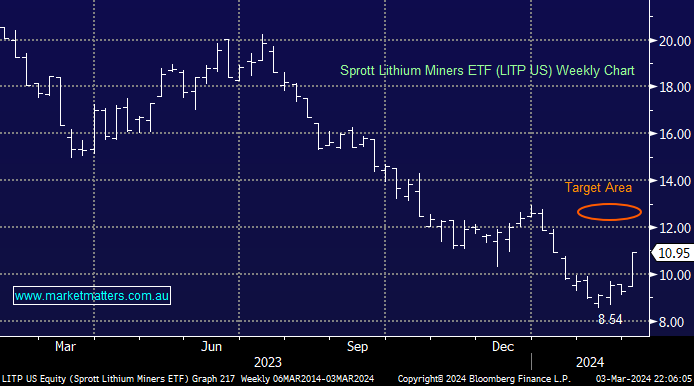

However, all good things usually come to an end and in the case of the lithium “shorters” last week was a tough one, with heavyweight Pilbara (PLS) bouncing +19.4% taking it up +10.9% year-to-date. There remains an astounding 21% of PLS held short (data is 4 trading days old), which must be feeling increasingly uncomfortable with the stock already up 35% from its January low. Importantly, we believe the recovery has another 15-20% to travel before it reaches our target flagged a few weeks ago.

- We are planning to review our exposure to lithium stocks ~15% higher, we must not forget this is a volatile cyclical sector that will provide plenty of opportunities over the coming years.