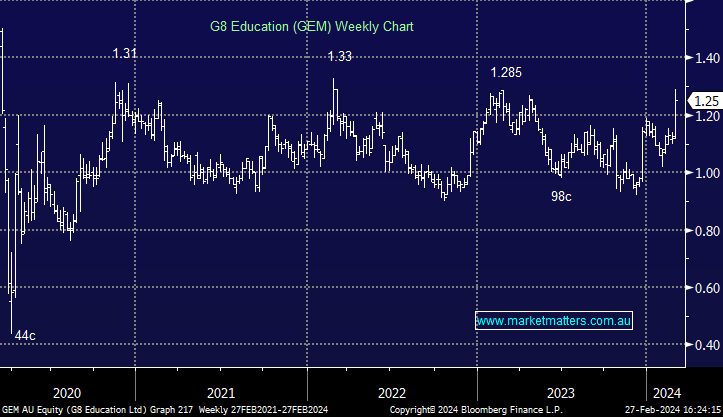

GEM +11.61% Rallied after reporting FY23 results that were inline with upgraded guidance released in Dec, with revenue of $982m up 9% YoY and above consensus of $967m while underlying profit (NPAT) of $63m was a ~4% beat to consensus of $61m. The final dividend was 3.0cps fully franked, inline with expectations. The key to the share price move today was reduced vacancies (finally) with the time to fill down 4% HoH, and when combined with a 4.5% increase in prices, the economics of their childcare network improves.

- We’ve had GEM on the Income Portfolio Hitlist for a while, and today’s result was a good one.