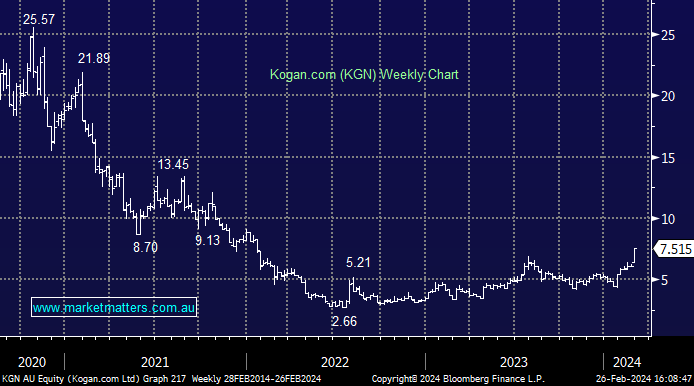

KGN +23.69%: Stormed higher today after announcing 1H24 results that had largely been pre-released, however, new information was incrementally positive with January trading showing they’re well ahead of consensus for the 2H (i.e. upgrades to come). Same time last year, EBITDA was running at $1.5m, they’re currently running at $4.9m. Cost reduction strategies are working without having an impact on sales which is key, while they’ve also made good progress on cost of acquisition and inventory levels. They declared their first dividend in 3 years (7.5cps).

- Overall, the margin recovery that they needed seems to be coming in earlier than many thought, earnings upgrades to come.