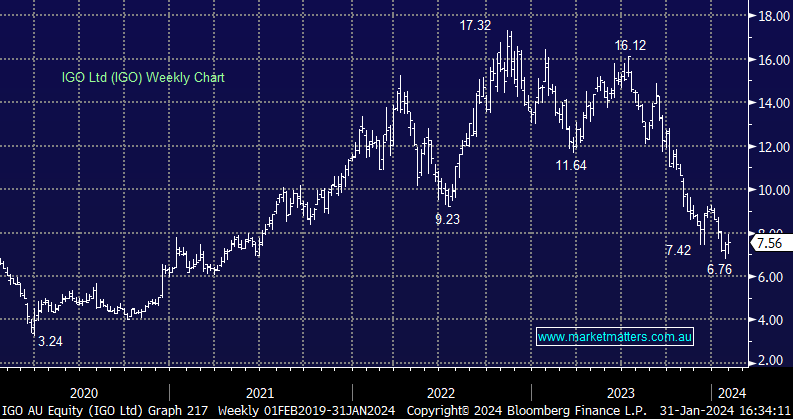

IGO -2.2%: The Nickel/Lithium company was out with a wide-ranging announcement this morning centred on their Nickel business which is grappling with cheap Indonesian supply hitting an oversupplied market, complicated further by operational issues that have plagued the assets purchased during the takeover of Western Areas:

- IGO is putting its Cosmos nickel project in Western Australia on care and maintenance and cutting jobs as a consequence.

- They’ll write down the value of their Nickel assets by a further ~$190m, having already taken a ~$1bn write down in July. They paid $1.3bn for WSA so they’ve written down the bulk of it!

- They also said the mine life would be shorter than the 10 years originally expected by Western Areas, and that there would be delays in getting the mine to full capacity to fill the processing plant and further increases in operating and capital costs. Seems a real cluster!

- In Lithium, they’re also easing back on production given the unfavourable pricing, and they made no sales of lithium hydroxide in the quarter, but had more than 3000 tonnes of the battery chemical stockpiled.

- For the 3 months to December 31, underlying earnings (EBITDA) fell 58% to $153 million

A tough update for IGO as they make some hard decisions around their Nickel business, once again showing how acquisitions can end up being a bag of problems.