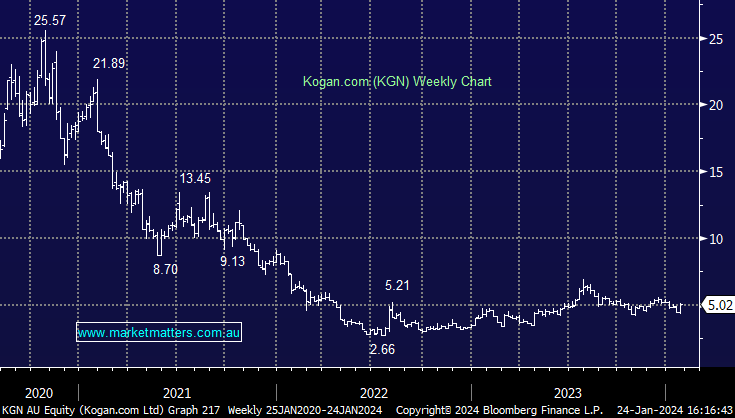

KGN +14.87%: today’s trading update from e-commerce retailer Kogan was a positive one highlighting how far the business has turned around in ~12 months despite facing consumer headwinds. Gross sales are expected to fall 5.6% vs 1HFY23, thanks in part to a shift towards platform sales. This shift has helped reduce inventory risks, an issue that plagued the company last year, as well as lift margins with Gross Profit Margin rising from 34.4% to 36% in the half vs 2HFY23, Gross Profit up 42% YoY as a result. The company expects first half EBIT of $14m when the company reports next month vs FY consensus of $17m, on track for a strong beat though no guidance was provided.

scroll

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM has turned Neutral/Bullish KGN

Add To Hit List

Related Q&A

What stocks would we top up here?

MM views on Qantas (QAN) & Kogan (KGN)

Our view on 3 online retailers

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.