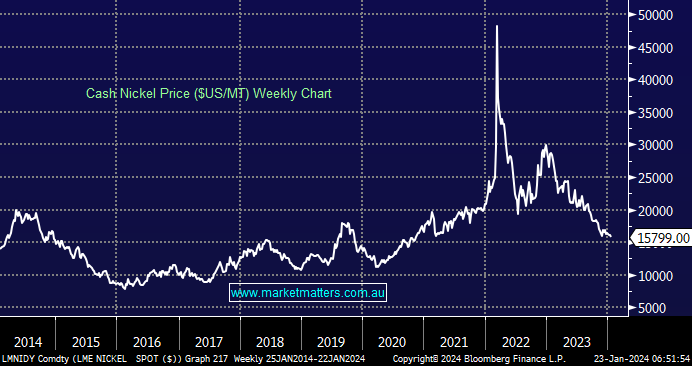

The collapsing Nickel price bears a painful resemblance to lithium, both of which are used in EV batteries. However, the surging increase in demand that was anticipated to propel the sector higher has arrived with a relative whimper, while supply has increased unabated from Indonesia in anticipation, with the result being a glut & depressed prices, e.g. the nickel price has halved over the last 12-months. We’re now seeing the likes of Twiggy Forest shutting down Nickel operations his private company Wyloo acquired just six months ago, while BHP is facing similar issues. Importantly its nothing new for a mine to go into “care and maintenance” in an industry that many investors forget is cyclical in nature, but it does come at a cost.

Booms and busts are commonplace in history across the commodities industry, with Lithium & Nickel certainly experiencing a bust, but as we’ve witnessed recently with Uranium this year, this can turn when the supply/demand dial reverses. Lower prices will ultimately solve the glut problem, as we are starting to see, but with largely Chinese-backed Indonesian production not horse-tied by emission regulations, it may take a little longer for Australian clean nickel to be competitive/economical.

- We believe the demise of nickel prices is coming towards an end but the path of least resistance remains down.

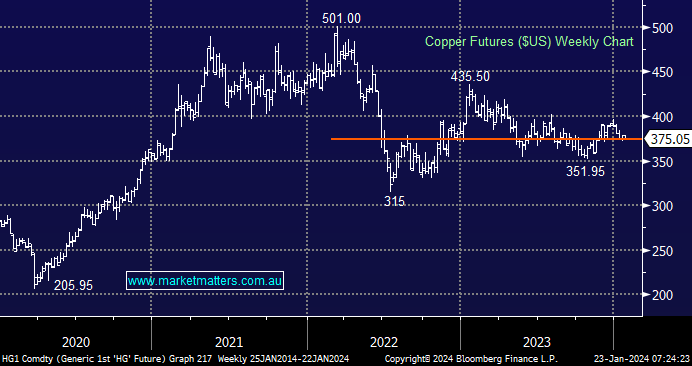

The Copper price has followed a totally different path over recent years, and it is sitting smack in the middle of its last 18-month trading range after attempts on both the upside and downside have failed to follow through – 2nd guessing what comes next in the short-term is too hard, but in the medium term, we do continue to like the outlook for Copper. China is by far the largest consumer and, as such, will determine the short-term swings in the commodity, but considering the poor performance of their economy, the industrial metal is holding up extremely well. Unlike Nickel & Lithium, Copper is expected to be in deficit, with demand outstripping projected supply.

- We like the supply/demand equation for copper in the medium term, but it needs China’s economy to show signs of recovery before meaningful gains for the industrial metal are likely to materialise.

We see no reason to be influenced by the carnage in Nickel/Lithium markets with regard to investing across the Copper sector over the coming year (s), but another test down towards the $US3.00/lb cannot be ruled out – note Copper has not surged higher as both Nickel and Lithium did on EV euphoria, and it has a broader set of applications.

This morning, we’ve looked at three ways of playing the Copper price as we commence 2024, both locally and overseas – note we’ve gone the purer route as opposed to stocks like Evolution Mining (EVN) and BHP Group (BHP), which generate a smaller proportion of their earnings from Copper.