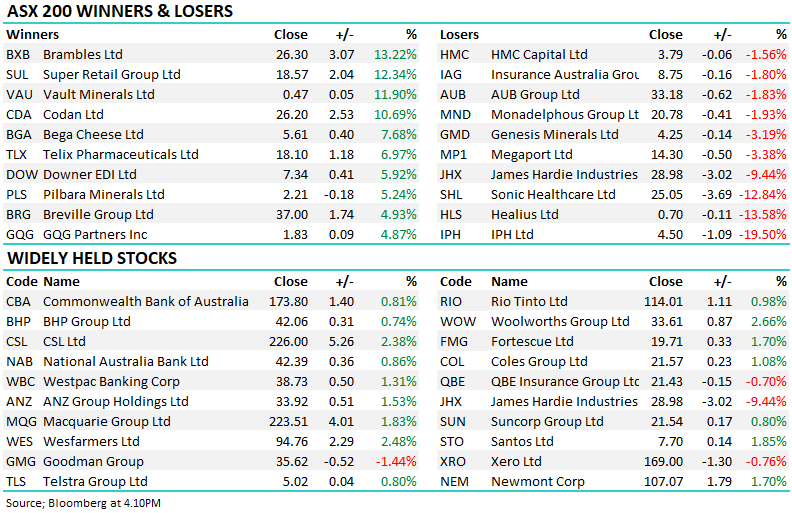

Apple is the largest company in the world, with a market capitalisation of US$3 trillion, or A$4.6 trillion. To put that number into context, the ASX is home to ~2300 companies with a total value of around A$2.5 trillion. Our largest company is BHP, with a market cap of A$235 billion followed by Commonwealth Bank (CBA) at A$175 billion. Apple could buy CBA with the cash in their bank account!

We have held AAPL in the International Equities Portfolio since its inception in June of 2019, a US$1 trillion company at the time. This week, the position hit a 300% return in ~4.5 years. We did trim the holding in June of this year, bringing it back to a 5% weighting at $US183.74. However, this was around prudent portfolio management rather than a negative view of the company. Overnight, Apple closed just ~5% below its all-time high of $US198.23, pretty phenomenal when we think about what has transpired since mid-2019.

While we review these stats with a smile, we also know that seeing a position in the portfolio up ~300% can pose more questions than answers for subscribers, the most crucial of which being, would we buy it today? The simple answer is yes, but with a suitable weighting and, importantly, recognising we’re not buying the same growth profile that we bought 4.5 years ago.

Apple is iPhone, and iPhone is struggling to grow. In 2015 they sold 231m iPhones globally, which was the peak of their phenomenal growth rate from just 1.4m units in 2007. In 2021, they sold 242m units, which fell to 232m in 2022. Total revenue this FY is expected to be $US397 billion, up 3.6% on last, while profits are expected to increase by 4-6% over the coming years.

- AAPL is no longer a high-growth company, and while a PE of 29x is fairly hefty, the consistency of their earnings and their unbelievable balance sheet does offset slowing growth.