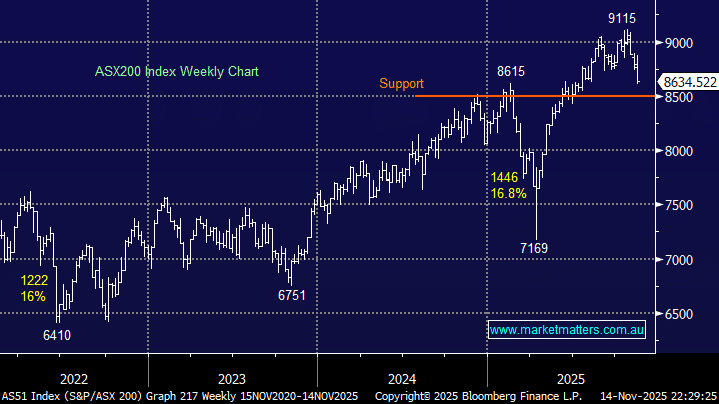

The sharp correction by lithium and its related stocks has been the undoing of many portfolios through 2023 after the year started with many investors wanting exposure to the EV revolution – we discussed it as a crowded space at the time, but its demise this year has been deeper than we imagined. Last week saw Lithium prices in China fall sharply to their lowest point in over 2 years after a trial delivery of the critical battery metal to the Guangzhou Futures Exchange indicated a larger-than-expected supply. The most active January Futures contract fell 10% on the week, and it tumbled another 6% through yesterday’s trade – spot lithium is down ~80% year-on-year.

The recent weakness has been caused by higher-than-expected availability of deliverable supply, with analysts and traders now calling prices down another 20% with little expectation for a pick-up in demand after Beijing ended its national subsidies for EVs. Goldman analysts said they expected an excess of 29,000 tonnes in 2023, with projections indicating that could swell significantly by 2024, while CITC Futures are saying that as supply growth outpaces demand, global lithium will register a 4% oversupply this year versus a deficit of 6% in 2021 and 2022. The resulting slowdown in demand for EV batteries has weighed on lithium prices, especially when combined with increased supply. However, we caution the bears that things always look their worst when markets approach a bottom.

- We aren’t trumpeting a low for lithium yet, but it’s far closer than its recent swing high!

The balance between supply and demand ultimately drive the price of commodities; hence, if lithium keeps falling, some supply will become uneconomic, and the traditional commodities cycle will take its next step towards balancing the supply-demand equation. Similarly, but in reverse, if gold does push to fresh all-time highs, we will see miners look to increase production to take advantage of the elevated prices.

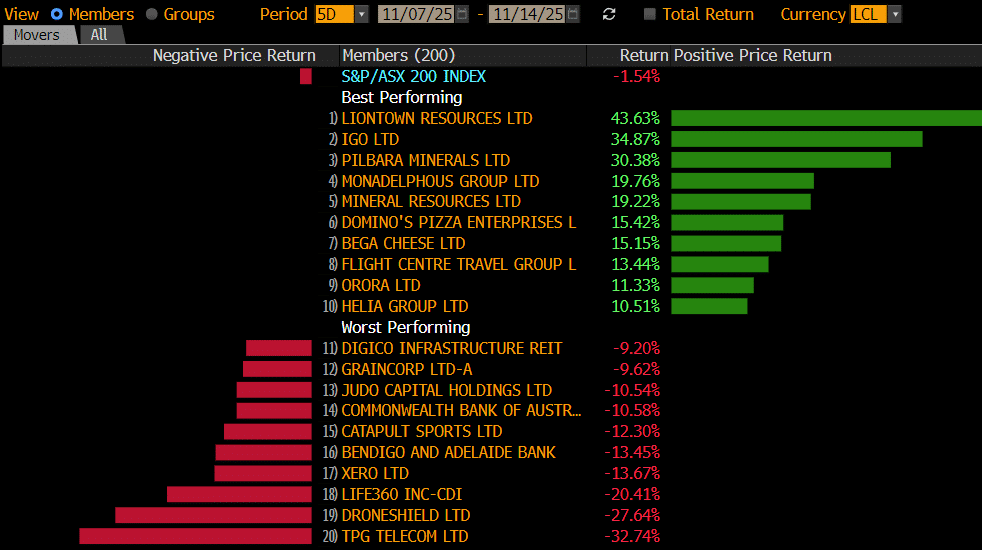

This morning, we’ve briefly revisited three major ASX lithium stocks as they plumb new 2023 lows – we believe lithium is starting “to look for a low” as the commentary on mass is talking lithium lower, a very different tale to last year where it was one of the most ‘crowded longs’.