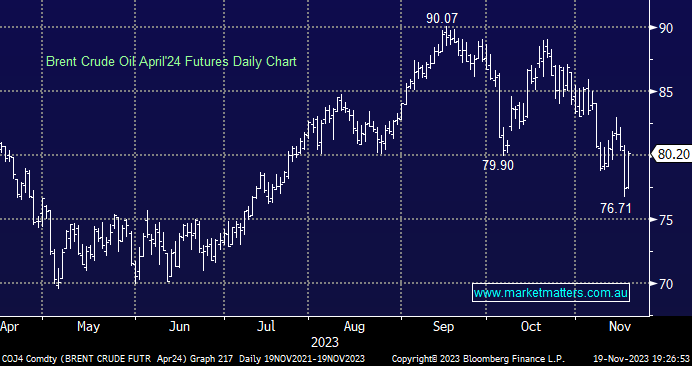

Crude oil bounced on Friday after making fresh 4-month lows earlier in November after Goldman Sachs said, “We believe OPEC+ will ensure that Brent oil prices end in the $US80-100 range through 2024 by ensuring a moderate deficit and leveraging its pricing power”. OPEC+ is set to meet in Vienna later this week, which looks to have seen traders/investors who held short positions taking profits after the 5-week decline.

- April’24 Brent Crude Oil Futures traded below $US78 as flagged last week, we now believe it’s time to adopt a more neutral stance into the OPEC+ meeting.

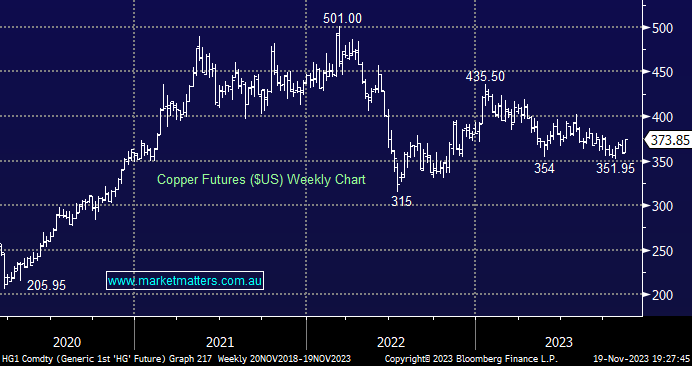

Copper advanced to 6-week highs on Friday after fears of a deep recession abated as markets called the end to rate hikes following the lower-than-expected US CPI print. So far, Beijing hasn’t convinced markets it can reignite China’s lacklustre economy, which is the catalyst bulls will be looking for to send the economic bellwether back towards its $US5.00 high posted in 2022.

- We are bullish towards copper short term, favouring a test of $US4.00 before a break under $US3.50 – a touch micro, but we still like the industrial metal medium term.