Audinate: USD falling headwind, Bond yield falling tailwind…

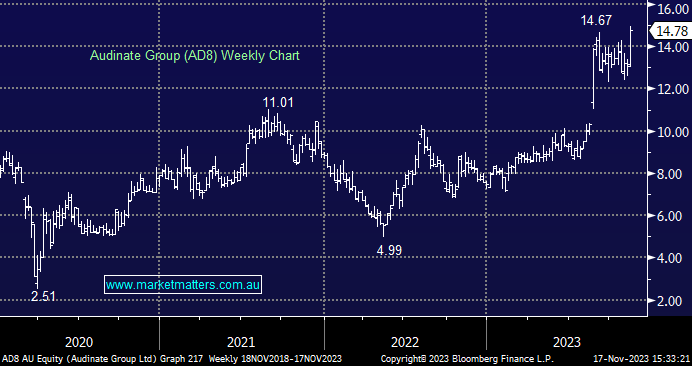

Hi MM Team, Recently you suggested taking profits/reducing Audinate (AD8) around $13 on the back of its good recent run and the anticipation that a falling USD may hurt their valuation. Since then the price has rallied another ~13% to now $14.77. With your view on (hopefully) falling bond yields in the medium term (which maybe has started to play out now) which should be a tailwind for the stock, I would very much appreciate an update on your AD8 view. Wouldn't falling yields provide a greater benefit than the falling USD, overall perhaps pushing the stock even higher in the next year or so? Many thanks, Michael