US stocks experienced a choppy session overnight, with the Dow falling under the weight of a weak Energy Sector while the tech names managed to eke out gains. After an almost euphoric style rally over the last fortnight, a few days of consolidation support MM’s roadmap higher into 2024. Bond yields fell overnight, but disappointing earnings from Walmart (WMT US), which fell more than -8% and a bearish forecast from Cisco Systems (CSCO US), down almost -10%, weighed down sentiment and broad indices.

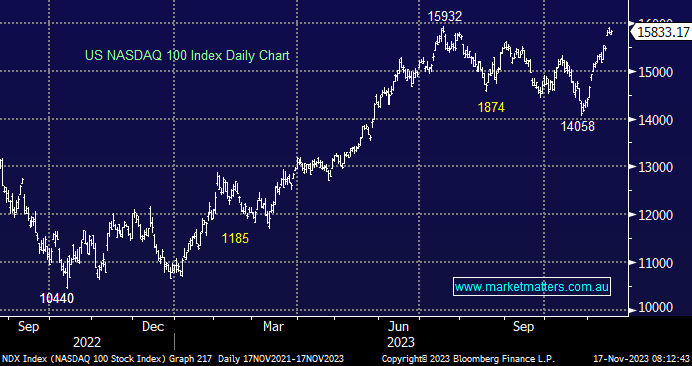

- No change; we can see US stocks posting fresh highs for 2023 into Christmas, led by “Big Tech” names.

Crude oil tumbled over -4% overnight, posting fresh 4-month lows in the process, an excellent move for central banks due to the knock-on effect on inflation. Prices fell as much as 5% at one stage as inventories rose and industrial production fell by 0.69%, with the numbers supporting the slower demand theory. OPEC meet on the 26th; it will be interesting to see if they attempt to engineer anything to arrest the free fall.

- We wouldn’t be surprised to see crude oil sub $US70 in early 2024; hence, we’re not looking to increase sector exposure anytime soon.