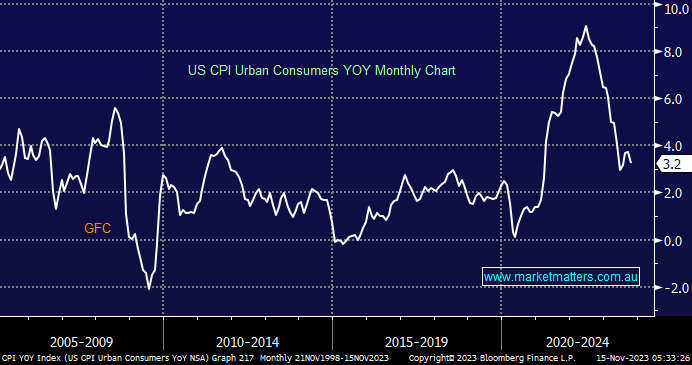

US indices surged overnight as US inflation came in below expectations; consumer prices rose +3.2% YoY for October, down from 3.7% YoY in September, which unleashed a flurry of buying across all sectors – remember, fund managers went underweight stocks in October! With US 10-year yields tumbling ~0.2% overnight, hitting levels not reached since September, equities are suddenly finding reasons to be cheerful.

- We continue to target fresh highs for the FANG stocks into 2024, but that’s not a big call now, only 1.5% to go!

US inflation emphatically resumed its descent in October, pulling inflation closer to the 2-year low reached in June/July. Wall Street rallied strongly last night on inflation-fuelled optimism that the Fed’s “endgame” is nigh, over 95% of the S&P500 advanced, with real estate and regional banks enjoying standout gains while the small-cap Russell 2000 Index outperformed, adding ~5.3%, well over twice the gain of the S&P500, i.e. in equities it was a big night of “risk on” and rebalancing portfolios as US 2 years plunged ~0.2% to below 4.85% and the $US fell -1.4%, the most since January.

- We can see US inflation retreating towards the Fed’s targeted 2% level, which will send yields & the $US lower, creating a tailwind for stocks.