What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

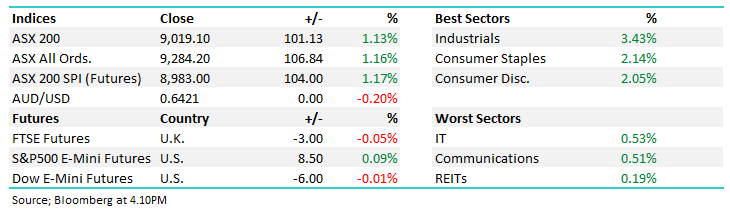

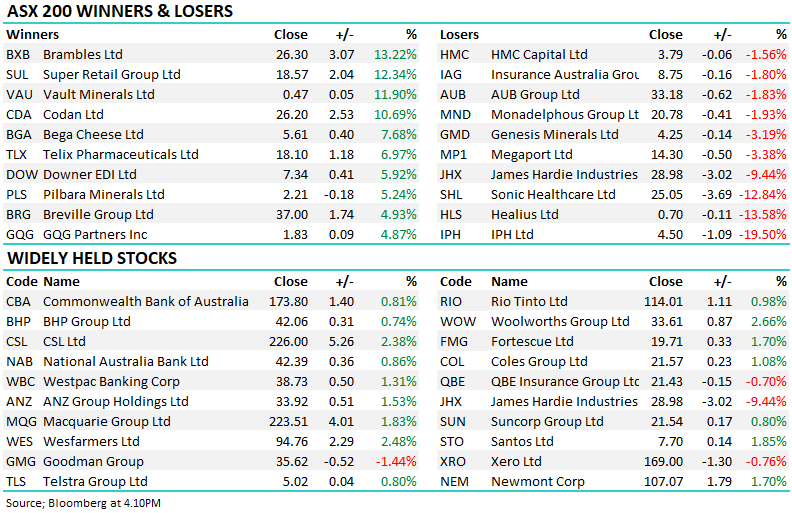

2023 has promised so much on several occasions but alas, with just 6 weeks left, it’s shaping up to be a disappointing year, especially when we consider that many term deposits are paying over 5%. Under the hood, 6 out of the 11 sectors are lower at this stage, but the loser’s enclosure includes the influential healthcare, financials and resources sectors, e.g. CSL Ltd (CSL) -12.4%, Westpac (WBC) -10.7%, and South32 (S32) -21.3%.

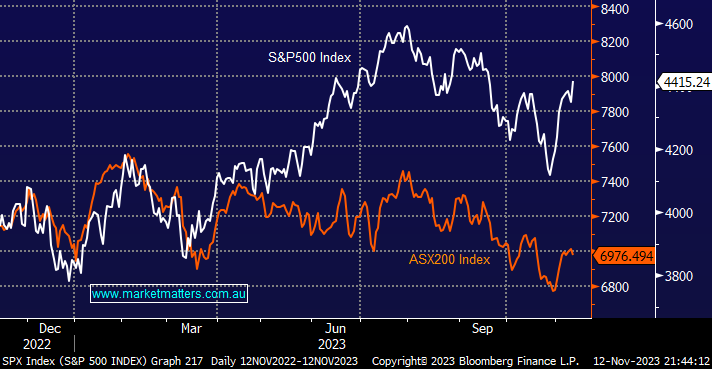

- Year-to-date the ASX200 is down -0.9% (excluding dividends) whereas the US S&P500 is up a healthy +15%, and that’s before the benefits of holding $US as the “Aussie Battler” struggles around 64c.

We regularly say, “The market can’t go up without the banks,” and that has proven true so far this year, with only ANZ Bank (ANZ) out of the “Big Four” higher in 2023. However, it’s easy to argue that overall, it hasn’t been too bad locally when we consider the surge higher by interest rates over the last 18 months, but US equities have largely shrugged off the hikes by central banks, leaving local investors a touch frustrated.

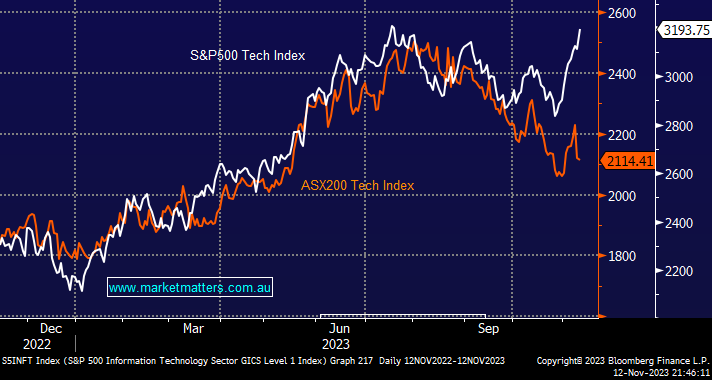

The local Tech Sector is up +16.5% year to date, but it doesn’t feel like it when we enviously consider the surge back towards all-time highs by their US peers, local sentiment was not helped last week by sector heavyweight Xero (XRO) down -11%. We went overweight the local tech sector in anticipation of an aggressive rally into 2024 led by their US peers. We got a few pieces of the puzzle correct, but our Altium (ALU) and Xero (XRO) positions show a paper loss of ~1% – we hold these two stocks in our Active Growth Portfolio.

This is an excellent example that adding alpha to a portfolio can sometimes be harder said than done. We picked the global macro picture, but it’s not delivered locally. Fortunately, we love the challenge that successful investing presents and have been in the game long enough to understand you have to roll with the proverbial punches.

- We still see local tech stocks being dragged begrudgingly higher into Christmas by their US peers.