Hi Alain & Tony,

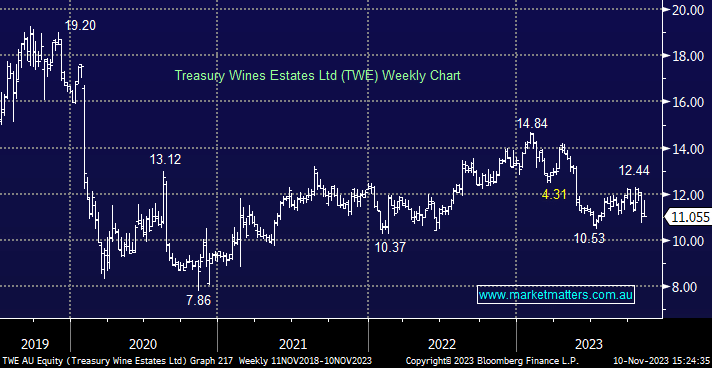

Treasury Wines (TWE) are raising capital to fund an acquisition as we’ve covered. This comprised an institutional placement and a retail entitlement offer, structured as an underwritten 1 for 9.45 pro-rata accelerated renounceable entitlement offer. Lets break that up:

- Underwritten: means an investment bank guarantee’s they will raise a certain amount. If retail share holders do not take up their rights, the bank will stump in the money (for a fee). It gives the company certainty.

- 1 for 9.45 pro-rata: For every 9.45 shares we hold, we have the right to buy 1 additional new share at $10.80.

- Accelerated: The time frame it is completed in.

Renounceable entitlement: Renounceable means the rights can be sold, and are listed on the ASX through the code TWER.

- The value of the rights is the difference between the current share price and $10.80. i.e. at $11.00, the rights have 20c worth of value.

- The holder of the rights can 1. Sell them on market 2. take them up 3. do nothing and potentially receive the difference in a cash payment when the shares, attached to the rights are placed in a bookbuild and sold to institutions.