Hi Josh,

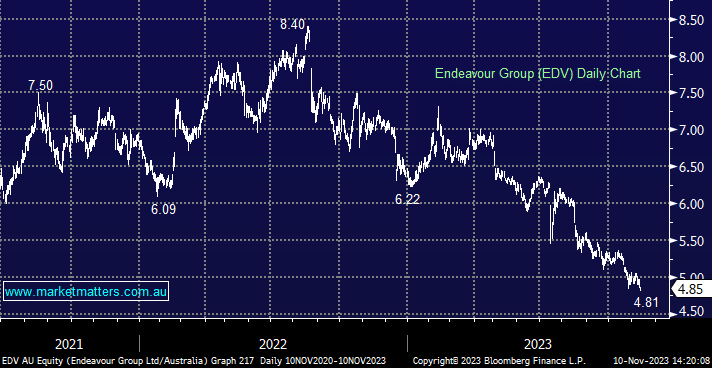

EDV has looked good value a few times in 2023 but it keeps plumbing new lows for 2023, even though Dan Murphy’s always seems busy! Pretty much in-line with much of 2023 the weak keep getting weaker, which in the case of EDV has taken the stock down to its all-time low, although the stock only hit the boards in mid-2021.

July was a tough month for EDV after Victoria introduced major restrictions on gambling which will hit earnings as they’re one of the largest operators of poker machines within their pubs and hotels division, this move also creates uncertainty around future earnings in a world were institutional investors are being pressured from an ESG perspective.

For a company that earns money through our ‘vices’ they really have to be a compelling investment to attract institutional interest, and right now, there is a fair amount of uncertainty around EDV’s likely earnings in FY24, about a 12% range between the most bullish earnings assumption and the more bearish.

At this stage we have EDV in the too hard basket although we acknowledge there’s plenty of bad news baked into the share price and its forecasted 5.6% yield over the next 12-months which is okay.