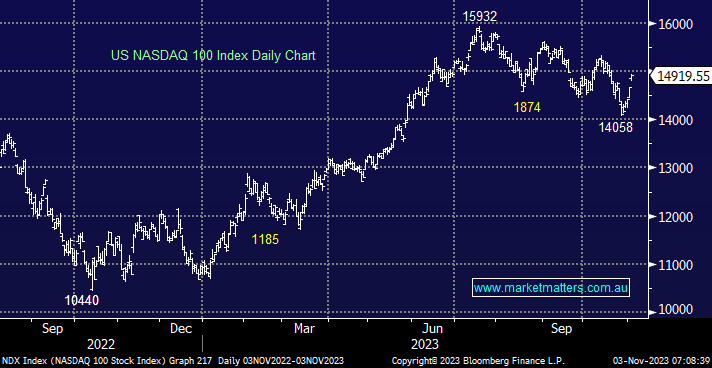

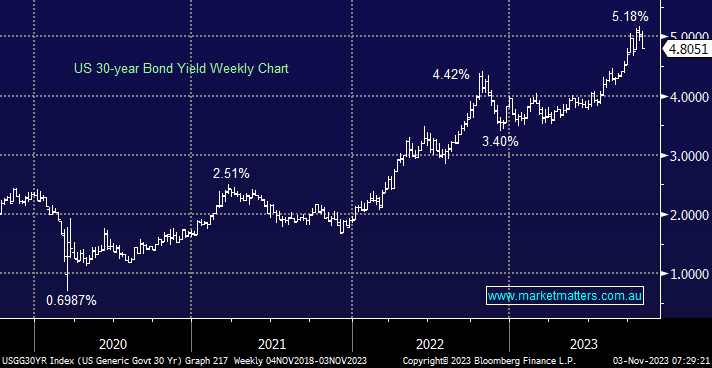

US stocks surged higher overnight, with the S&P500 enjoying its best day since April, fuelled by oversold conditions and bearish fund manager positioning, which MM discussed earlier in the week. The S&P500 added +1.9%, sending the VIX (Fear Gauge) below technical support, i.e. an encouraging sign for the bulls. Tesla (TSLA US) jumped over +6% while Apple Inc (AAPL US) rose over +2% before it reported after market. Long-term treasuries saw yields fall, with the 30-years down 13 basis points to 4.8%, which weighed on the influential $US.

As we approach the important jobs data on Friday, a report overnight showed jobless claims rose for the 6th straight week, suggesting people who lose their jobs are finding it harder to rejoin the workforce as we approach Christmas – a traumatic situation for many, but the silver lining is rates are less likely to be hiked further.

- No change, we can see US stocks enjoying a Christmas rally, with the question now being, has the journey already begun – it looks like it has.

Bond yields fell lower overnight as the implications of comments from the Fed hit home, i.e. we may have already seen peak interest rates. If MM is correct, bond yields are/have topped, which will provide an excellent backdrop for equities, as we’ve seen over the last 48 hours.

- We are looking for the US 30s to test initially below 4.5% over the coming months.