US indices rallied overnight, reducing losses for October but still registering its first 3-month losing streak since 2020, the S&P500 closed up over 0.6% near the session’s high – bond yields surging to levels not witnessed for 16-years have weighed on stocks through September/October. Real estate and financials outperformed on the sector level while it was a mixed bag under the hood of the influential tech sector, with NVIDIA (NVDA US) and Meta Platforms (META US) closing lower. Caterpillar (CAT US) disappointed the market with its outlook for the 4th quarter, sending the stock down over -6% and weighing on the Dow, which only finished up +0.4%.

- We are still looking for a Christmas rally starting in November, supported by the fund managers’ aversion to stocks through October.

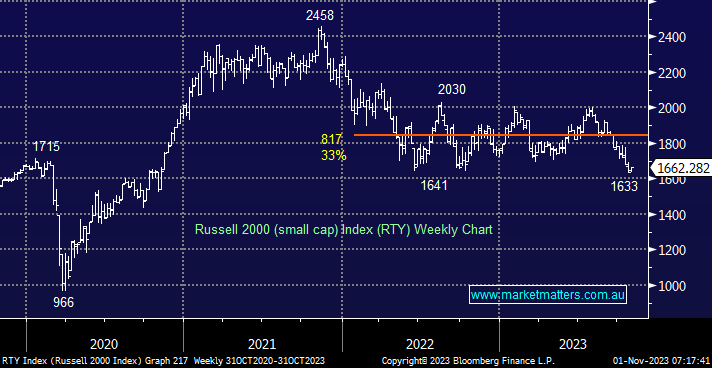

The Russell 2000 (small cap) Index broke below its 2022 support at the end of October, although it has already bounced back into the last 18-month trading range. From a risk/reward perspective, we now like the small caps for a strong bounce into 2024, i.e., a drop below 1600, and we’re wrong until further notice, less than 4% below its overnight close.

- We believe the break by the US small caps to fresh three-year lows could prove a classic “Bear Trap”.