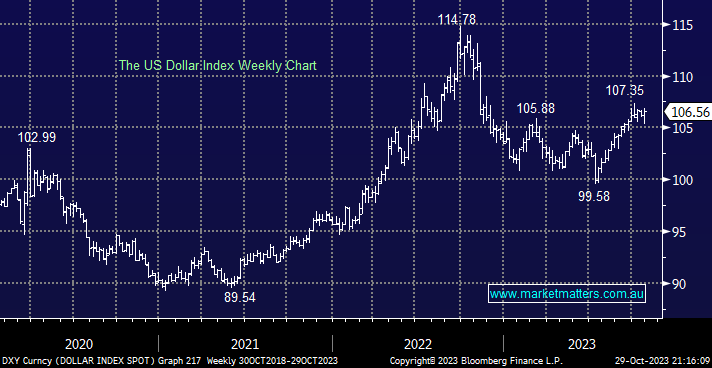

The $US ended a quiet week slightly higher as it remains the currency of choice during these uncertain geopolitical times. The $US has been consolidating its bounce from the psychological 100 area since late September, and what comes next in the short term, unfortunately, feels like guesswork at this stage.

- No change, we remain net bearish towards the $US, but the short-term war in Israel will likely keep the Greenback firm.

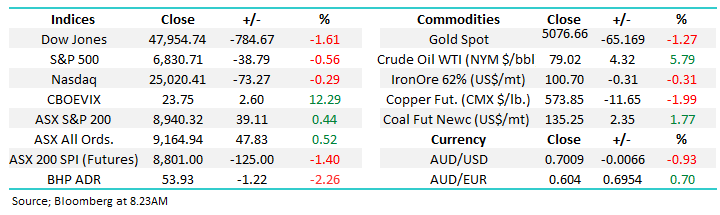

The Euro has pulled back to its 2023 lows, although, unlike equities, it is holding support for now. We wouldn’t be surprised to see the Euro make fresh 2023 lows around the 1.04 area, but at this stage, we believe it would afford a good risk/reward buying opportunity.

- Over the next few years, we are looking for the Euro to test the 1.23 area, its post-COVID high.