BSL rallied +1.7% on Thursday, helped by this week’s upgrade by Citigroup from neutral to Buy following the stock’s recent ~20% drop. Earlier in the month, the company cut 1H24 EBIT guidance by ~12% to A$620-670m; we felt the bulk of this downgrade was driven by lower US mini-mill realised spreads making up ~$80m of the downgrade and BSL Properties Group ~$10m sale project slipping into 2HFY24.

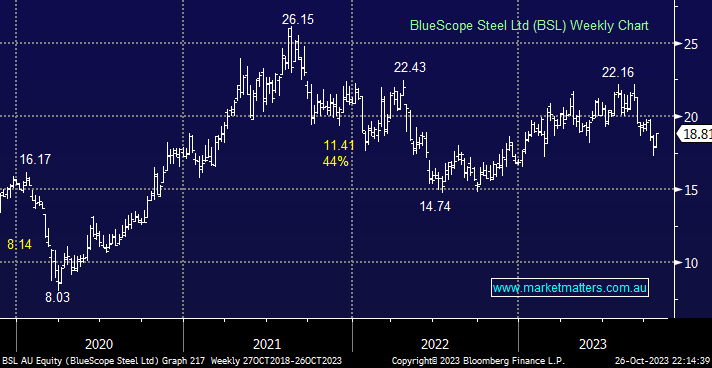

- We can see BSL holding ~$19, but we won’t be considering the stock this side of Christmas after the recent downgrade – buying stocks after downgrades has crushed alpha in 2023.