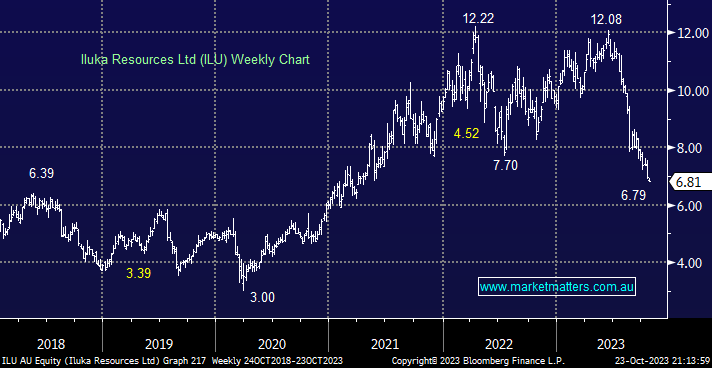

The selling in mineral sands and future rare earth operator ILU has intensified after the company announced that they would pause some production of synthetic rutile as uncertainty around the global economic outlook weighs on demand. It’s unlikely the stock will regain its “mojo” until the news flow improves, even if it does appear to be offering value sub-$7. This is an example of a stock that disappointed through reporting season; hence, it’s not on our menu through current weakness even after its major decline.

- We prefer MIN, PLS and IGO in the battered corner of the Resources Sector, i.e. ILU is too hard to even after correcting -44% over just a few months.