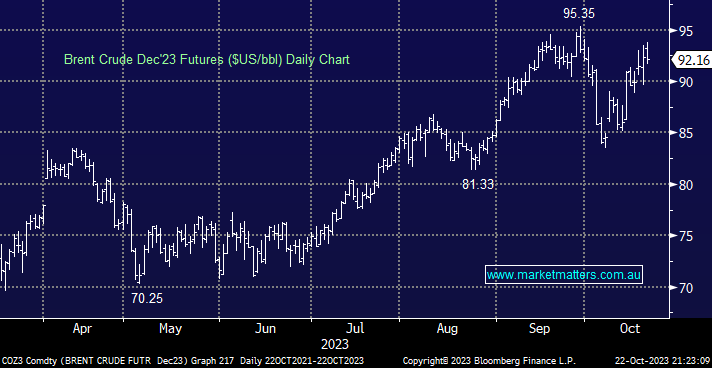

Crude oil closed unchanged last week, largely ignoring tensions in the Middle East which should have been supportive of the commodity, i.e. we don’t like markets that cannot rally with fundamental tailwinds.

- We remain mildly bullish on crude oil, but its inability to test its September high during recent conflict is a concern.

Copper again edged lower last week on concerns the conflict in the Middle East will hinder global growth, while China’s property crisis shows no signs of improving, e.g. the Shenzhen CSI 300 Index fell over -4% last week to test its 4-year low.

- No change, we are bullish toward China and copper in the medium term, but an initial break under $US350 feels like an increasingly likely outcome.