We have discussed the Aussie a number of time over recent weeks as it continues to struggle to find any meaningful buying whatever crosses the newswires. The local currency is being weighed down by a US economy that remains stronger than our own plus its less dependent on the uncertain outlook for China. Over the last two and half years the $A has fallen by ~20% against the Greenback and until Beijing successfully convinces the markets its economy is on the path to recovery it’s hard to envisage the bearish trend changing direction.

- We can see the $A testing the 60c into Christmas, not good for overseas holidays!

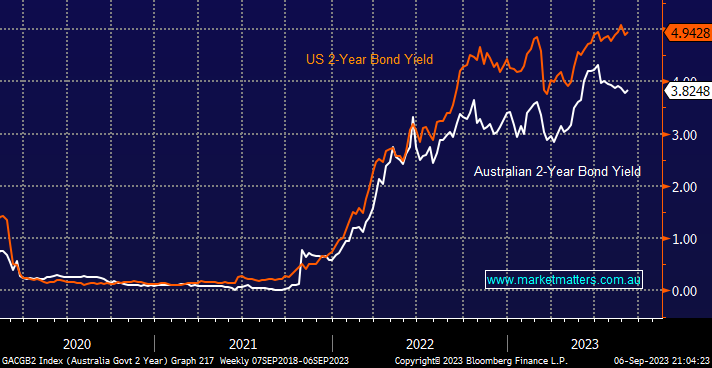

Overnight we saw further signs of economic strength out of the US after a stronger than expected reading on the US services industry, this was enough to push US 2-Year yields back above 5%, well over 1% above the Australian equivalent i.e. monies held in the US are receiving a higher yield than at home. The US economy has been outperforming our own for over a year pushing up the yield differential and we see no signs of a change in the foreseeable future.

- We see no contraction in the yield gap between the US and Australia in the near future.

A 20% increase by the $US against the $A should by definition deliver a major tailwind for the ASX businesses who earn a significant portion of their revenue in $US with the healthcare and miners initially coming to mind followed by some specific industrials. Ironically the Healthcare Sector is enduring a tough year, especially by its standards, while the miners are struggling to capitalise due to uncertainties from China. This morning we have deliberately looked at 3 stocks outside of the 2 obvious sectors that should be revelling in the weak $A to assess whether individually we believe they are still offering some opportunity.