What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

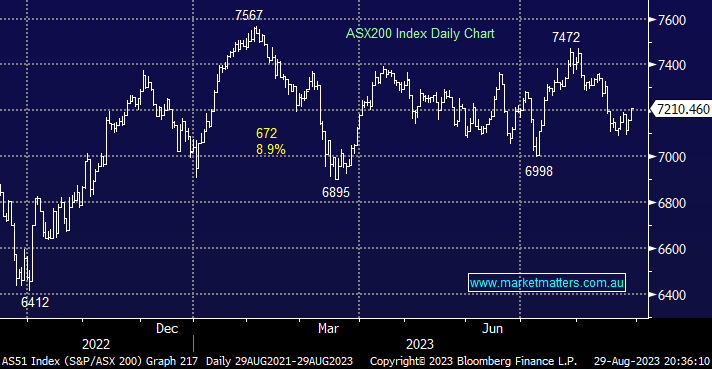

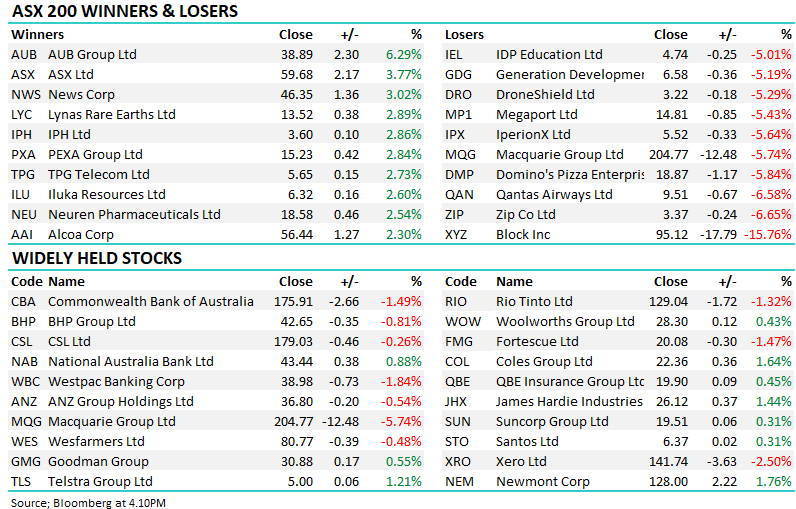

The ASX200 enjoyed a strong +0.7% advance on Tuesday led by the Materials Sector with the lithium, gold, and iron ore names all enjoying a day in the sun e.g. Minerals Resources (MIN) +8%, Pilbara Minerals (PLS) +5.1%, Gold Road Resources (GOR) +4.6%, and Fortescue Metals (FMG) +3.2%. MM has been bullish on the miners for months looking for a catalyst to increase our sector exposure, we now believe Beijing is delivering the appropriate backdrop as it slowly but surely continues to pull the stimulatory levers:

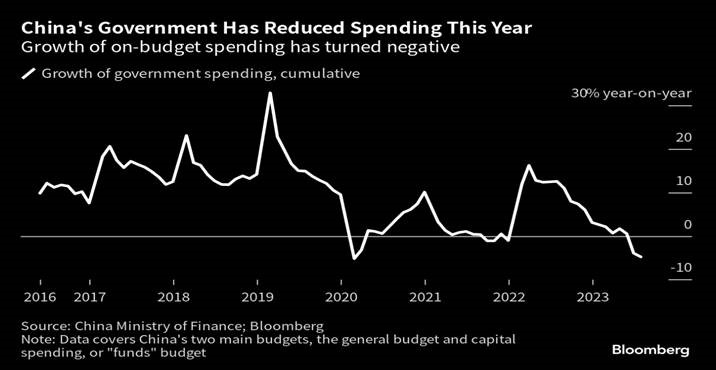

- Monday saw China vow to speed up its fiscal spending to boost its economy i.e. largely a reiteration of Beijing’s policy stance but one we don’t believe should be ignored.

- Overnight we heard that China’s “Mega” banks are cutting rates on mortgages and deposits to boost economic stimulus/growth.

China has noticeably reduced spending so far in 2023 hence this is an effective 180-degree turn which should provide a tailwind for the resources stocks. Yesterday Finance Minister Zhang highlighted China’s economic challenges reiterating that growth momentum is not strong and the current environment is “full of uncertainties” – we anticipate more targeted measures over the coming weeks/months with markets likely to start taking notice sooner rather than later.

So far 2023 has been relatively tough on the local miners under the combined weight of ever increasing fears of a global recession and the much discussed problems China is experiencing reinvigorating its economy after its severe zero-COVID policy e.g. Alumina (ALU) -29.6%, South32 (S32) -14.3%, Mineral Resources (MIN) -11.2%, RIO Tinto (RIO) -5.8% and BHP Group (BHP) -4% – note the ASX200 is still up +2.4% year-to-date even after a tough August. However, after correcting ~13% from its 2023 high we believe the sector is poised to surprise many pundits on the upside.

- We like the risk/reward in general towards the Materials Sector after its ~13% correction with an assault on the 20,000 area being our preferred scenario.

The ASX200 enjoyed solid broad based gains on Tuesday with well over 60% of the main board ending the session higher while the previously top performing Tech Sector -0.3% was the worst on ground – at MM we remain bullish tech but we do believe the rally is maturing fast and some names might disappoint this side of Christmas. As reporting season comes to a close MM was happy to see Minerals Resources (MIN) surge +8% yesterday after enduring a couple of weak results through August, especially in the Healthcare Sector. Overall it has been a reporting season of 2-halves with FY23 stronger than many expected but FY24 forward guidance has been disappointing in a number of cases as management have adopted a cautious/conservative approach.

- This morning the SPI Futures are pointing to an opening by the ASX200 up +0.6% following a strong session on Wall Street which saw all 11 main sectors close higher