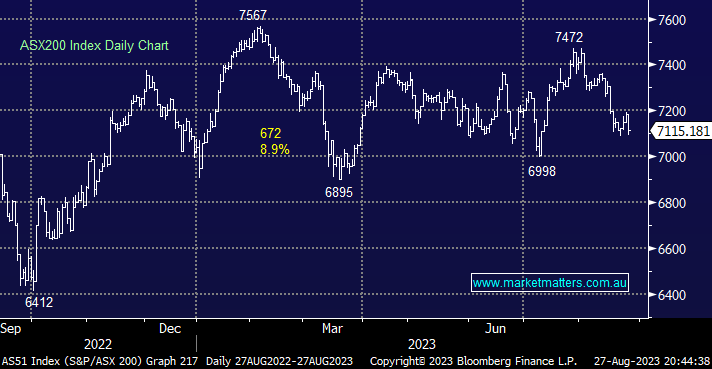

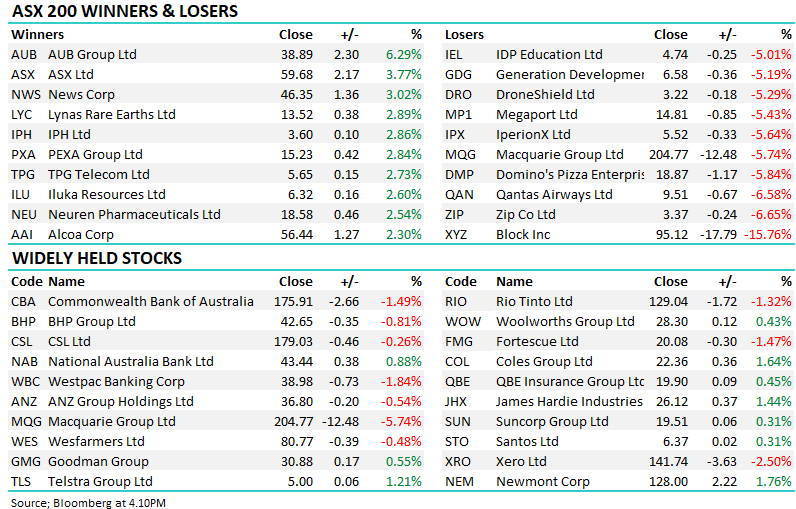

The ASX200 ended last week less than -0.5% lower with moves again focused on the stock level as companies that missed or beat in their earnings reports/outlooks dealt with uncompromising aggression in both directions e.g. Altium (ALU) +29.5%, HUB243 (HUB) +12.9% and Alumina (AWC) -15.8%, Iluka (ILU) -14.8%, WiseTech (WTC) -14.7%. While Reporting Season starts to taper off, it will still have an influence this week particularly at the smaller end of the market, early on we see results from Fortescue (FMG), NEXTDC (NXT), Mineral Resources (MIN) and Praemium (PPS) all stepping up to the plate in the next 2 days.

In the weekend report, we wrote something that we feel warrants repeating in case some subscribers missed it “ Trends in earnings and forecasts are incredibly important, perhaps more so now because there are a lot more computer-driven quantitative assessments happening in the background, scanning the market looking for incremental changes to momentum, not just price momentum but changes within the fundamental picture of a company, even if they are small. This continued growth in “quant” is perhaps a reason for more exaggerated and longer lasting moves on either side of the ledger following results.” i.e. the stretching elastic band we often refer to.

- The SPI Futures are calling for the ASX200 to open up +0.3% this morning following Friday’s positive session on Wall Street – BHP Group (BHP) was up just 10c in the US.

US indices bounced on Friday enjoying a lack of unexpected bad news from Jackson Hole – the drop this time last year was “ugly” with stocks driving lower into mid-September. This week will be a real test of investors’ appetite for US stocks after having the weekend to digest the key takeaway, that US interest rates are set to be “higher for longer”. Our preferred scenario is we will see a few more months of “risk on” but we are conscious that the strong rally from Q4 of 2022 is maturing.

- We remain bullish towards US equities short term as indices have followed our road map through July/August.

Chinese facing stocks have struggled for over 5-years although the current media make it sound like a new phenomenon as Beijing struggles to reinvigorate their economy post strict COVID lockdowns with their pivotal property market garnering most of the bearish headlines. Sunday evening saw the Ministry of Finance announce a 50% cut to stamp duty on stock trades to help boost their flagging market – in our opinion, Xi Jinping, the PBOC and co are slowly pulling the stimulatory levers and when least expected they will start to win the arm wrestle propelling stocks higher.

- We like the risk/reward toward China facing equities into current weakness.