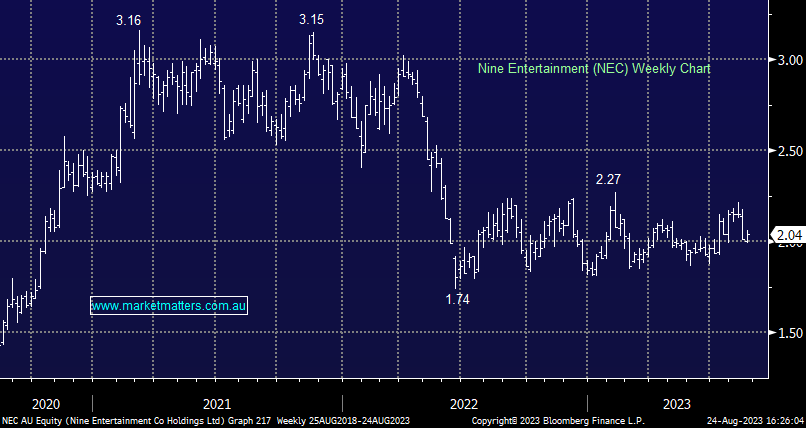

NEC +0.49%: FY23 results showed the headwinds being faced by traditional media sources, however, the numbers weren’t as bad as feared. Revenue was largely in line while EBITDA fell 16% to $591.2m, a small miss to expectations. The company also reduced their final dividend to 5cps, down from 7cps. Free-to-air TV was actually better than expected despite facing significant margin pressure. A softer advertising market was offset by an increase in market share with Nine’s portion at a 20-year high. The more exciting part of the business is its investment in Stan which managed to expand margins while seeing revenue growth of 12%. Price increases have helped drive growth here with little issue in retaining subscribers, the business is also expected to see a bump from a number of sporting events in the next few months. The company said the ad market has continued to face headwinds, ho,wever the start of FY24 has shown signs these headwinds are easing.

- An okay FY23 for NEC, it’s cheap and seems to be doing well given the cards being dealt from a macro standpoint