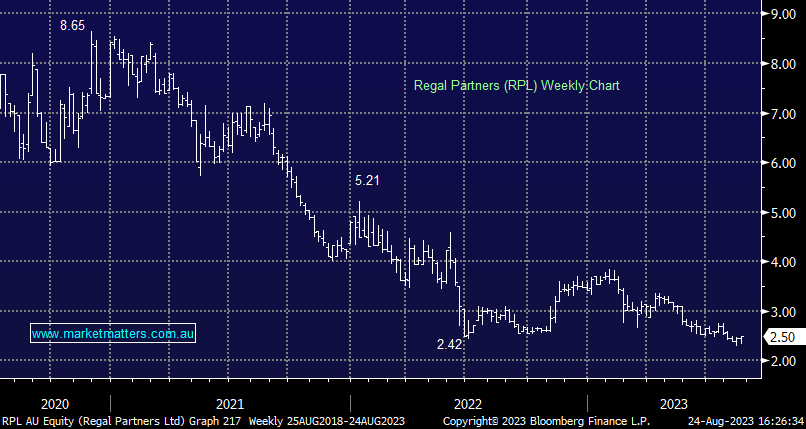

RPL +5.49%: The fund manager announced strong 1H23 numbers today with Net Profit up 98.5% to $13.1m, covering more than half of the FY23 consensus numbers in the process. Costs fell 10.7% as they realised synergies following the VGI Partners merger completed last year. Flows have been strong, FUM was up 23% in the last 12 months largely thanks to strong performance numbers in new and alternative investment options. They had $234m cash in hand at the end of the period, making up about a quarter of the value of the business and supporting plans for more M&A.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM is bullish RPL ~$2.50

Add To Hit List

In these Portfolios

Related Q&A

Are Regal Partners (RPL) and IDP Education (IEL) a reasonable entry point ?

Regal Partners (RPL) and IDP Education (IEL) – oversold companies?

Regal Partners (RPL) performance

Regal Partners (RPL) and Smart Group (SIQ)

Dividend Trap?

Fund Managers

Does MM now like Regal Partners (RPL)

Is Regal Partners Limited (RPL) worth a punt?

Queries on FSLR, FTCH (US) and CLX, RPL (ASX)

Can MM please clarify your thoughts on Regal Partners (RPL)?

Thoughts on RPL & MAAT please

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.