What Matters Today in Markets: Listen Here each morning

The ASX200 edged higher on Tuesday although the +0.1% advance camouflaged another extremely busy day on both the stock and sector levels. In a similar fashion to yesterday, Reporting Season delivered some major volatility at the pointy end of things with the top 3 performers in the ASX200 soaring an average of +18.1% while the equivalent in the loser’s corner slipped -7.7%. The winner’s enclosure was dominated by the Tech Sector which closed up an impressive +5.2% conversely the Consumer Staples -2.5% and Healthcare -0.9% Sectors caught our attention for the wrong reason, interestingly according to the press we are in a very nervous market yet the “risk on” names are leading the charge, both this week and throughout 2023:

Aggressive sector/stocks: Tech +37%, Consumer Discretionary +11% and Communications Sector +10% e.g. Xero +68% & Wisetech +69%, Eagers Auto +30% & Super Retail +23% and lastly REA Group +46% & Carsales.com +34%.

Defensive sector/stocks: Healthcare -5%, Financials -3%, and Consumer Staples -2% e.g. Ansell -19% & CSL Ltd -7%, Westpac -11% & CBA -4%, and lastly Endeavour Group -15% and Coles Ltd -3%.

Last year MM accurately forecast the reversion back into tech stocks which helped our MM Invest Active High Conviction Portfolio outperform most of its peers, however, while we didn’t expect the rate-sensitive tech stocks to outperform say healthcare by over 40% by this stage of 2023 the current momentum suggests there’s more on the upside hence we added to our Xero (XRO) position last week. Over recent months we’ve been looking for a catalyst to increase our resources exposure as China slowly starts to pull their stimulus levers but so far patience has proven the prudent course of action. As we keep saying the song remains the same:

- The strong keep getting stronger and the weak weaker on both the stock and sector level – WiseTech (WTC) may challenge this trend today!

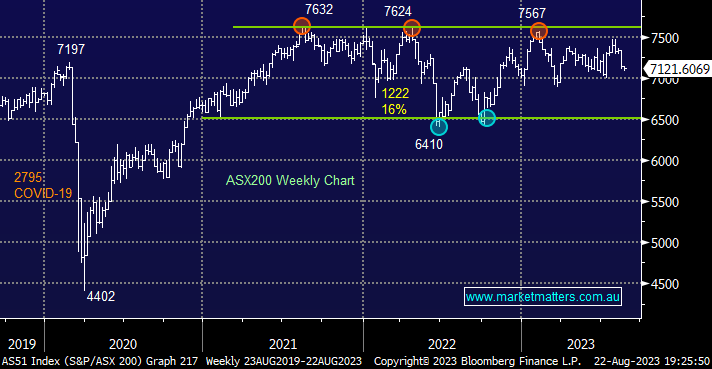

The ASX200 edged higher on Tuesday as reporting season dominated local stocks although attention is slowly moving towards Jackson Hole where we hope to get a read into the current mindset of central bankers. While we don’t expect any forward guidance from Powell and Lagarde, they won’t be telling us when/what the next move will be for interest rates, there are likely to be clues as to their current feelings, a common occurrence during their closely followed speeches – with US 10-year yields around 15-year highs, we believe the markets are bracing for bad news hence if it’s not too bad equities could rally strongly.

- The SPI Futures are pointing to a -0.2% dip early this morning following a soft/cautious session on Wall Street.