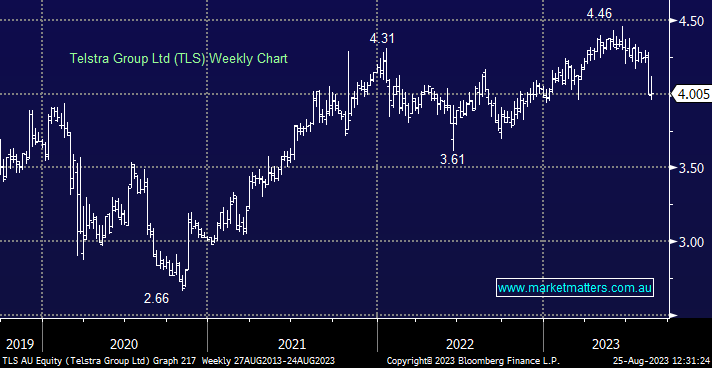

Your opinion on TLS, TPG, PPT, APA for dividends

Hi James, Keep up the good work! I am looking for something that pays a good dividend with some possibility of growth and is unlikely to be taken over. Telstra and TPG come to mind. Do you like either of them using those parameters? If not why not. Personally I have long had a low opinion of Telstra but times change and one must change with them. Also, I hear little news of PPT these days. Do you think it is a good long-term high yield company? I own some APA and have been hearing some negatives about the company. Is there reason to be alarmed or concerned. I suspect not, but,times are changing quickly. Paul