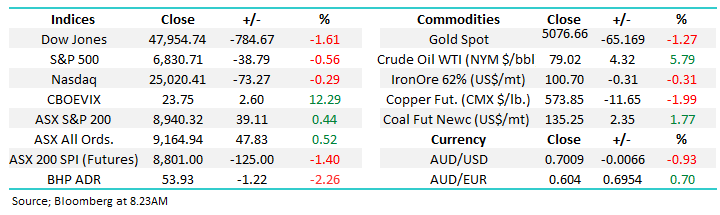

The $US posted fresh 9 week highs last week as the Feds hawkish rhetoric made the Greenback and its respective bond market ever more attractive as yields ground higher. However as markets position themselves for higher yields at this week’s bond auctions we believe much of the news is already built into the $US and short term risk/reward has swung back in favour of the bears.

- No change, in line with our view on US bonds we’re net bearish towards the $US but we continue to caution a short-term bounce towards 105 would not surprise.

The recently strong $US has reversed some of the Euros strong gains since Q4 of 2022 and this stage it looks set for a deeper pullback although we do eventually expect to see the Euro test the psychological 1.20 area, over +10% higher i.e. the short term implication is that precious metals in particular will continue to struggle over the coming weeks/months.

- We are bullish toward the Euro medium/long term but for now the path of least resistance is back toward the 1.05 area.