Help with Bank Hybrids please?

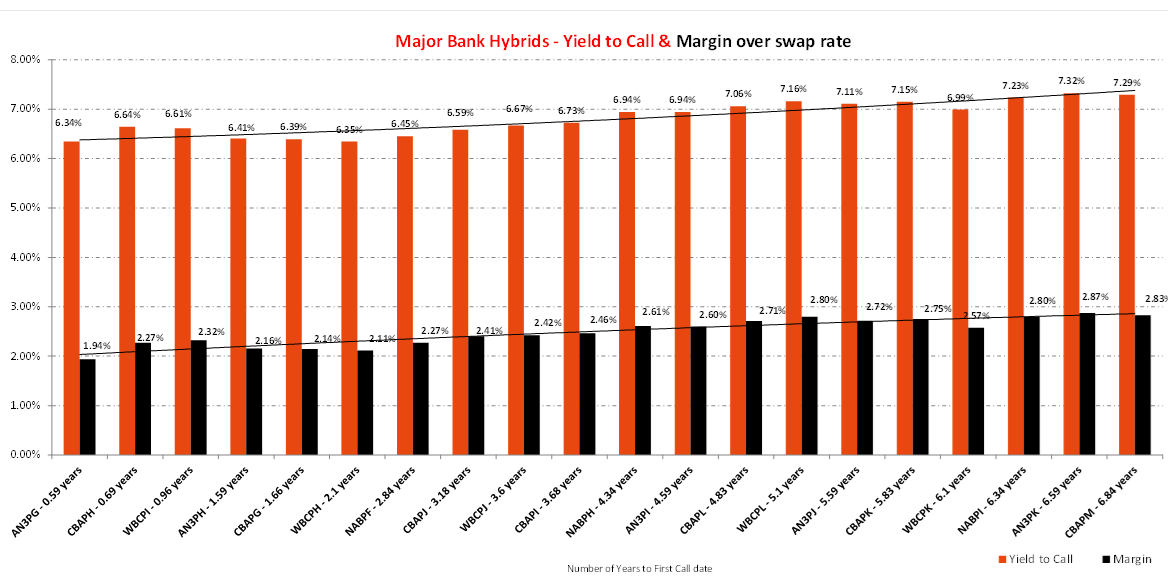

It would be great if you could set out the ABC of Hybrid selection and ownership. Question 1. I have several Bank Hybrids. Amongst them are some AN3PG that are 7 months from their first optional exchange date. The prospectus states "On 20 March 2024, ANZ has the right to Exchange ANZ Capital Notes 4, subject to certain conditions including APRA’s prior written approval". The Mandatory Conversion Date is 20 March 2026. Is this usually what happens? On the first optional redemption in March 2024, the bank can elect not to redeem the Bank Hybrids. In this case, I can decide to continue to hold these Hybrids until "another date" or the Scheduled or Mandatory Conversion Date of March 2026, rather than sell the Bank Hybrids on the ASX at the prevailing market price now. When the Hybrid reaches the Mandatory Conversion Date, will owners have to decide to let the Hybrid convert into shares(at a probable loss?) or sell the hybrid on the market as best as possible to protect their capital, while at the same time needing to determine future dividends Question 2. Looking at the Shaw and Partners strategies Hybrid list you send out(thankyou) I sometimes think as a buyer, I just select from the right hand side of the bar graph, where the highest returns are working my way left (Yield to call/ Margin over swap rates are displayed)