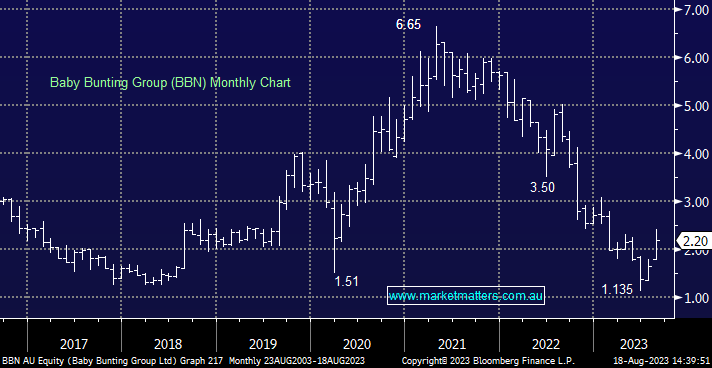

Baby Bunting (BBN) high risk opportunity or just hype?

Good morning, I have found your recent notes really interesting, thank you! I have been hesitant to jump on the share price rising momentum for Baby Bunting. Their latest results were not surprising and no guidance was offered for FY24, yet the share price jumped. Historically, this business has demonstrated it can deliver and grow profitably. Does MM believe BBN's management can successfully navigate the current market conditions and deliver the growth strategy? Thanks, Angela