What Matters Today in Markets: Listen Here each morning

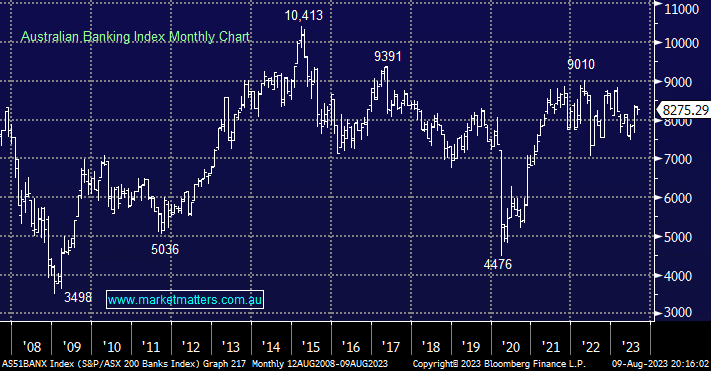

The banks returned to form with a bang on Wednesday following CBA’s solid FY23 result with margins holding up extremely well despite the much-discussed increased competition. While the result may not have been outstanding there was nothing not to like from margins to dividends and even a surprise $1bn buyback which illustrates their strong capital position and confidence by the board. The commentary was understandably cautious as we all wait to see if the RBA, and fellow central banks, can successfully rein in inflation without plunging the global economy into a recession.

- CBA will pay a $2.40 fully franked dividend on the 16th taking its FY23 dividend to $4.50, there was an understandable lack of sellers with the dividend due on Wednesday.

- Yield-hungry investors who buy CBA this week are set to receive ~$7 worth of dividends, all fully franked, over the next 12 ½ months – pretty enticing stuff.

- Portfolio Manager James Gerrish was on SBS News yesterday following CBA’s CEO Matt Comyn, discussing the result – Watch Here

The market has been worried about increasing bad debts as the “mortgage cliff” rolls across Australia but so far so good on the repayments front, hence banks have enjoyed rising rates which have helped to improve margins when bad debts have remained much lower than expected, at least for now. The result from CBA emphasised the sector’s resilience at this stage of the cycle and even as discretionary spending falls employment has remained strong offsetting major concerns towards the banks.

- We continue to like the banks but remain buyers of dips as opposed to chasers of strength

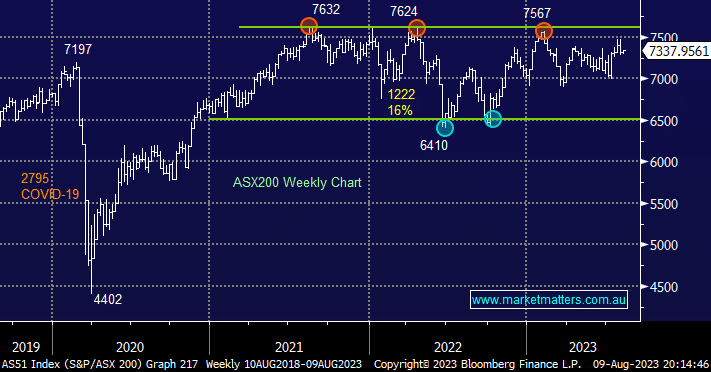

A strong advance in the afternoon saw the ASX200 finish up +0.37% on Wednesday, close to its high although only 54% of the main board closed up, the “Big Four Banks” closing up an average of +1.8% was always going to deliver a strong tailwind for the broader index. Outside of the banks, it was a fairly lacklustre session as we await the market’s interpretation of today’s wave of results from the likes of AGL Energy (AGL), AMP Ltd (AMP), Megaport (MP1), QBE Insurance (QBE) and Boral (BLD) – MM Reporting Calendar.

- We have been looking for a period of consolidation/pullback by global equities, but any downside moves by the local index are noticeably quickly attracting buyers.

- The ASX200 is poised to open unchanged this morning after Wall Street drifted lower ahead of this week’s US CPI (inflation) data.

This morning we’ve briefly looked at 3 stocks we own which caught our attention yesterday in the winners enclosure only 7/8 weeks after all looking particularly average:

- In the current market bargains are coming after “bad news” but swing lows are taking longer to form and are generally deeper than most people expect.