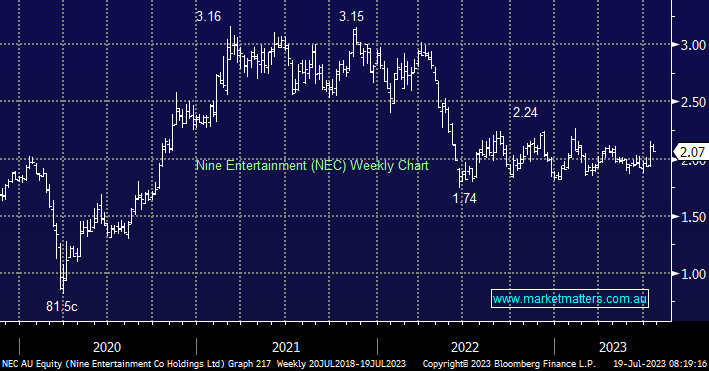

Monthly media data for June was released this week, showing a continuation of the decline in ad spending, largely across the board. TV ad bookings fell -15.7% yoy in the month which compares to Nine’s guidance for around a 15% decline at an update in May. Bookings for FY23 were down -12.4%, though it is important to note the numbers are cycling a very strong FY22, and a slowdown was expected. This clearly creates a headwind for earnings in the case of Nine Entertainment where around 60% of earnings (EBITDA comes from TV and Radio. Analysts have priced in a ~15% drop in EBITDA for FY23, and NEC trades on ~13x PE, meaning it is cheap and priced for the ongoing headwind in our view. However, it’s harder to see a catalyst to push the stock higher, more likely to come from growth in Stan or Domain Holdings (DHG) rather than the traditional media business lines Nine runs.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monday 8th September – Dow off -220pts, SPI off -15pts

Monday 8th September – Dow off -220pts, SPI off -15pts

Close

Close

MM is neutral NEC, looking to take profit ideally around $2.20.

Add To Hit List

In these Portfolios

Related Q&A

Nine Entertainment Co Ltd (NEC)

Nine Entertainment (NEC) and Southern Cross Electrical (SXE)

NEC and APX

AMP, WOW, NEC

Is the market getting it wrong on NEC?

Will Media company be in focus for coming financial year ?

Your thoughts on CTD and NEC, please

MM view of NEC & HVN

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Monday 8th September – Dow off -220pts, SPI off -15pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.