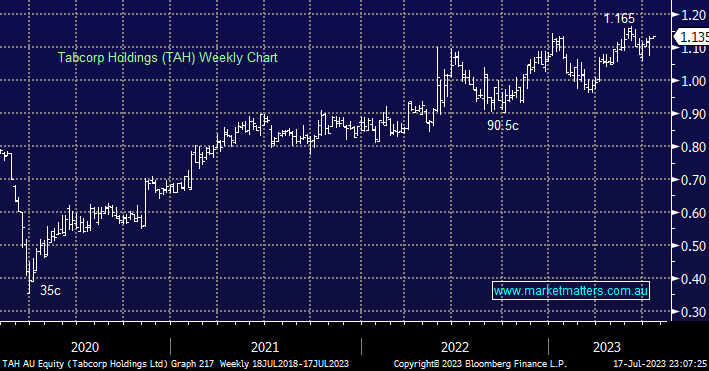

We find it hard to like TAH at current levels, especially after their recent investor day flagged a more challenging trading year ahead due to the likes of cost-of-living pressures and regulatory scrutiny, the latter has already been discussed earlier. This is a classic case of a solid business at the wrong price and an expected yield of sub 3% over the next 12 months adds to the argument to prefer cash over TAH at current levels.

- We like TAH but the risk/reward above $1.10 is not appealing.