What Matters Today in Markets: Listen Here each morning

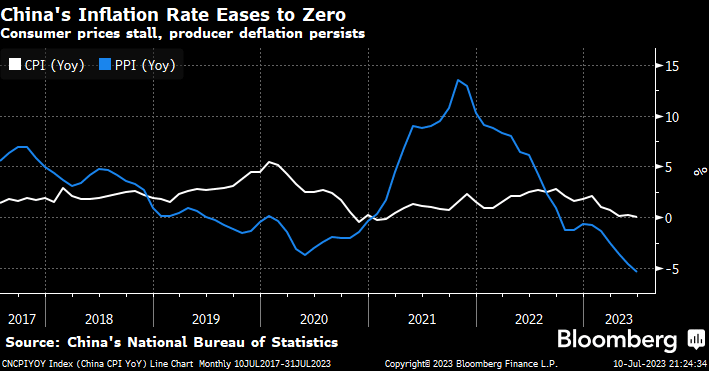

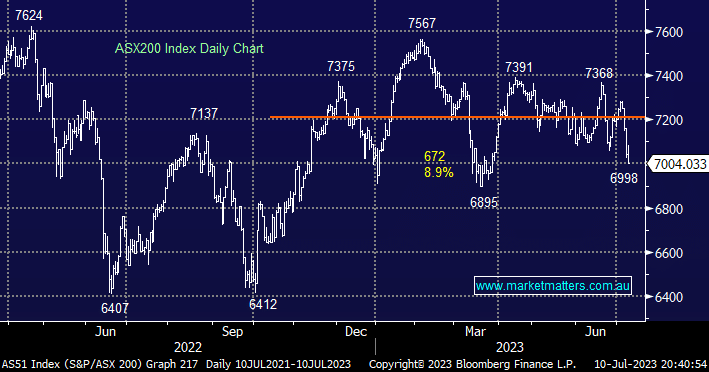

The ASX put in a very disappointing performance on Monday reversing decent early gains to close down over -0.5%, only 61% of the main board finished lower but when heavyweight resource stocks fall along with average performances by the banks and CSL the index usually follows suit. However, the miners were the standout weakest link with BHP Group (BHP) -1.1%, RIO Tinto (RIO) -1.1%, Fortescue (FMG) -2% and South32 (S32) -3% all weighing on the index. The catalyst for the falls was again China’s economy which is on the brink of deflation:

- China’s consumer inflation rate was flat in June while factory-gate prices fell further fuelling ongoing concerns around Beijing’s handling of their economy post severe COVID lockdowns.

Both of these numbers suggest that China’s recovery is weakening which clearly argues for policy easing by the PBOC but as MM alluded to over recent weeks we believe they will ultimately press the “go button” in 2H but only when XI Jinping et al are good and ready, not when the rest of the world suggests they should. The problem for commodities is falling prices can become self-fulfilling as consumers/businesses hold back hoping for cheaper prices e.g. pork prices are down -7.2% over the last year.

- We believe the Australian miners are offering compelling value but investors shouldn’t underestimate how much further they could slip i.e. consider accumulating as opposed to going “all in”.

- The Chinese housing market uses 17% of the current copper supply hence the short-term weakness by the industrial metal as the transition to green energy unfolds.

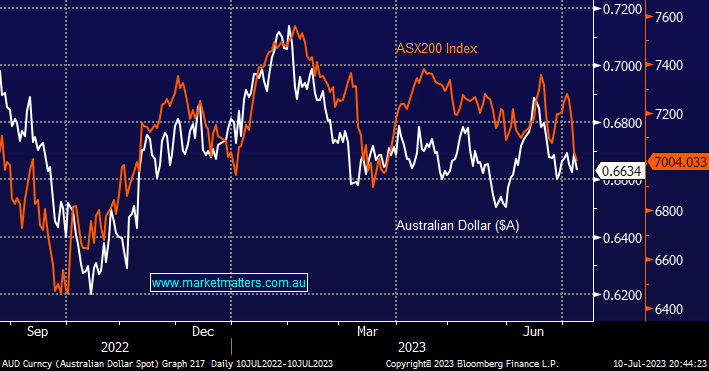

The weakness in the Chinese economy has caused a knock-on effect on the $A courtesy of the Australian economy being highly correlated to demand from the world’s 2nd largest economy – China has kept us out of a recession before, but this time it could cause us to struggle compared to many of our peers. Unfortunately, many Australian industries are dependent on China and until Beijing lays out a credible roadmap to recovery it could be a rocky road e.g. miner South32 (S32) which MM has been “stalking” through 2023 has already fallen a whopping -45% from its January high.

The performance of the ASX is highly correlated to the $A, especially from a relative performance perspective and until the $A can regain its “Mojo” it’s unlikely the ASX200 can challenge the 7500 area again, unfortunately, there’s no clear leader in the correlation which affords investors like ourselves with no useful triggers.

The path of least resistance for the ASX has been on the downside since early June when aggressive SPI Futures selling suggested some major overseas players were reweighting out of Australia – the subsequent decline in both the ASX & $A has made the selling look on point, at least short term. Hopefully, recent weakness will see them return in 2H as a compelling valuation story unfolds for investors holding foreign currencies but it’s likely to require some optimism out of Beijing before there’s any stampede back towards our shores.

NB A significant number of International Fund Managers don’t hedge their overseas positions hence if they are long an ASX and the $A falls -10% it’s just the same as the respective equities declining by the same degree.

Overnight positive moves on Wall Street are set to flow through on the ASX this morning, when our session ended on Monday the S&P500 futures were pointing to a -0.5% drop by US stocks but the four major US indices closed higher, led by the Russell 2000 small cap index closing +1.65%.

- The ASX200 is poised to rally +0.6% this morning following strength in the SPI Futures with the Industrials, Financial and Energy Sectors likely to be firm.