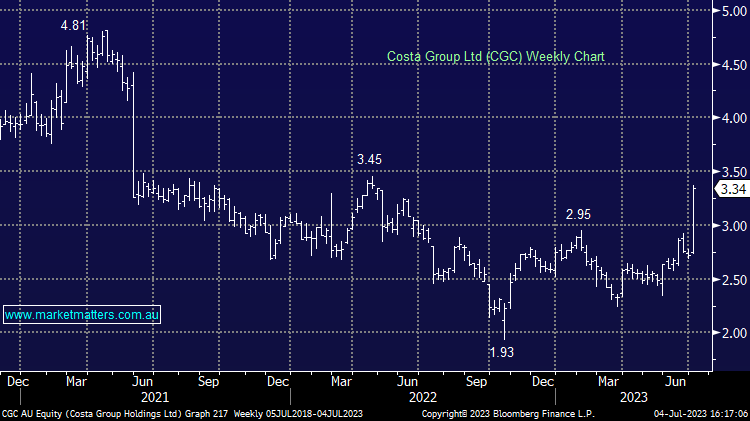

CGC +12.08%: The fruit and veg grower, packer and marketer rallied today on a private equity takeover tilt lobbed at $3.50 per share. Paine Schwartz Partners had acquired 13.78% of CGC in October at $2.60, at the time saying they had no interest in taking the lot, however, we now know that was smoke and mirrors with the specialist in sustainable food chain investing back at the table, having completed 4-weeks of due diligence. There are some conditions associated with the bid, however, they know CGC well, have been a large investor for 10 months, have already received Foreign Investment Review Board (FIRB) backing and have the $$ to complete. In other words, this is a highly credible bid with a high chance of completing at the stated $3.50 per share, which would include any dividends declared before they wrap up the scheme of arrangement.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM believes the bid is highly credible, and will likely complete

Add To Hit List

Related Q&A

Yield Options / RUL indicative proposal

RPMGlobal Holdings (RUL) FY25 Report

Car Group Ltd (CAR), Wisetech Global (WTC) and RPMGlobal (RUL)

RPMGlobal Holdings Ltd (RUL) Update

What is MM’s view on RPM Global (RUL)?

Thoughts on Costa Group (CGC) after recent news?

Thoughts on CGC and SIQ please?

What are MM’s thoughts on CGC?

MM view on Costa Group (CGC) & Fenix Resources (FEX)

ALL, CTD, CGC, A2M

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.