Hi Rob,

Thanks for the positive feedback and commitment to the MM service, I can ensure you we will endeavor to continually grow and improve all aspects over time!

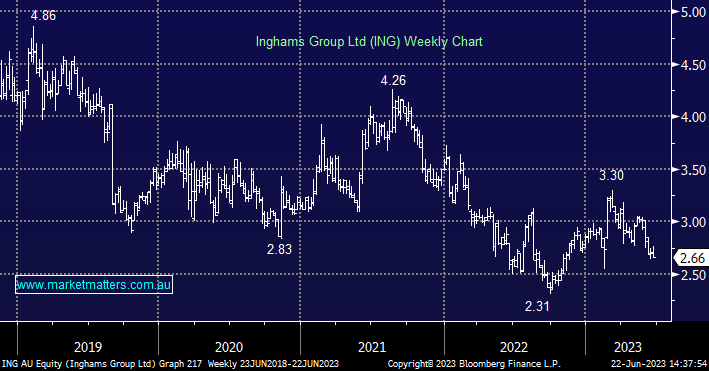

Chicken is indeed regarded as cheap form of protein which should be a beneficiary of tough economic times but ING have been struggling operationally, their FY’23 half-year result showed profit was -13.1% weaker, weighed down by supply chain disruptions and broad-based inflationary cost issues – the latter of which we suspect is the reason why the share price continues to struggle.

To give come context here, they will likely generate ~$3bn in revenue in FY23, but only make a $64m profit, in 2018 they did revenue of ~$2.4b and generated ~$110m profit, so while revenues have been going up, profits have been going the other way which shows how tough it has been. FY23 results are set to be released on 17th August and will be very important for ING, and while we like the stock for the reasons you highlighted, we would rather wait for those results to see if profits have turned the corner (last year they did $42m).