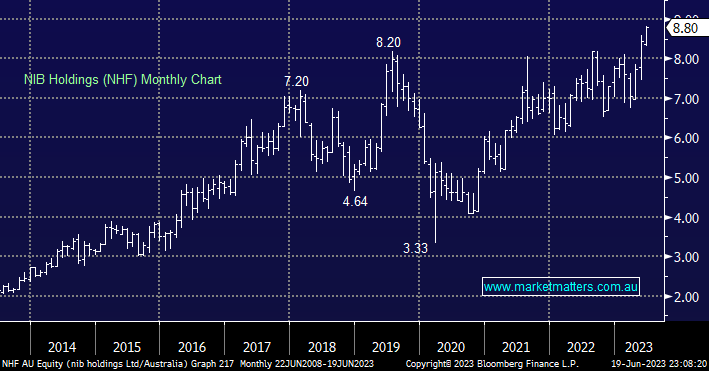

NIB has rallied to fresh all-time highs this month with the sharp sell-off following its disappointing earnings report in Q1 a distant memory. The stock has been strongly re-rated on the upside over recent months due to the positive combination of strong migration trends and low claims. The stock isn’t cheap trading on an Est. 21.6x valuation for FY23 but history tells us that buying stocks with strong momentum often makes sense.

- We cannot chase NHF as it approached $9 but it’s not an advance we would fade either.