Arguably the weak link of the MM Flagship Growth Portfolio through 2023 has been our overweight healthcare exposure i.e. we have 13% in the Healthcare Sector which is above the 10% of the broad index. Hence, if we are overweight a sector that’s not delivering results we must reassess, especially after its largest member and the 3rd largest stock on the ASX suffered a rare negative rerating yesterday:

- CSL fell -6.9% yesterday after pouring cold water on analyst FY24 assumptions.

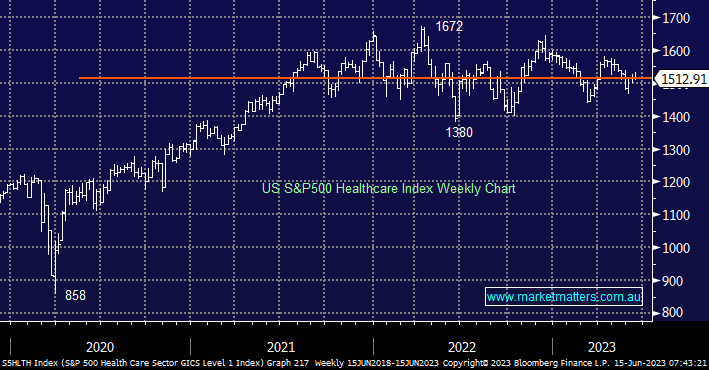

Before we delve into some of the main local healthcare stocks, including our holdings, we have taken a quick look at the overall position of the US Healthcare Index which is not dominated by one stock unlike our own i.e. the topical CSL. On the sector level, the US healthcare names have rotated around unchanged for around 2 years although obviously there has been more action on the stock level.

Today we have considered ways we may tweak/reduce our healthcare exposure over the coming weeks/months as opposed to abandoning it altogether.