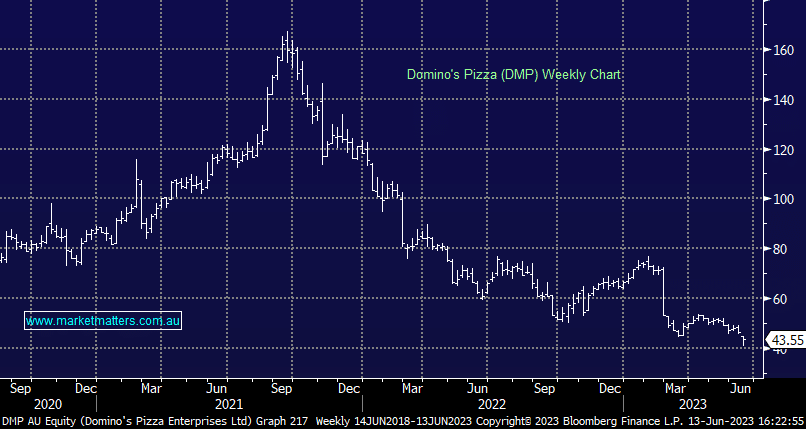

DMP -5.86%: the pizza franchisor fell to a 3-year low today after announcing it was looking to close several underperforming stores combined with a poor trading update. They’ll start by wrapping up the 27 stores in Denmark, a small group they bought out of receivership in 2019 which has failed to improve materially since acquisition. The company also plans to close a further ~70 corporate stores and bring on franchise partners for another ~70 corporate stores. These changes plus a handful of other streamlining operations are expected to add $53-59m in EBIT annually while costing $80-93m over FY23 & 24. Sales have been lacklustre this year, running at +0.2% in the second half, well below the 3-6% target, while costs have also been squeezing margins. We see no reason to catch the falling knife into new lows.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM is neutral to bearish DMP

Add To Hit List

Related Q&A

Broker price targets

Turnaround Opportunities

DMP/CKF as possible growth/dividend stocks

DMP & Chemist Warehouse

Does MM like Dominos (DMP) capital raise?

Does MM like CKF &/or DMP?

What are MM’s thoughts on Domino Pizza?

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.