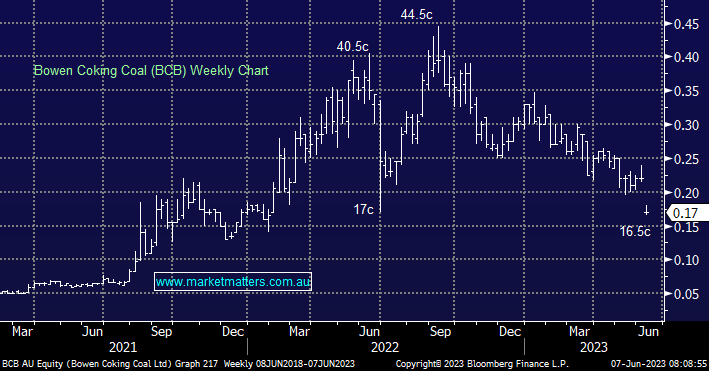

The Queensland-based met coal miner raised $40m during the week at 17c a share in a deal that was priced at a 22.7% discount to Thursday’s close before shares went into a trading halt. The deal includes a fully underwritten $10m Share Purchase Plan (SPP) which will open to retail shareholders shortly. As holders, the cap raise is frustrating, given it was done at a deep discount and is highly dilutive as a result, adding around 12.7% to shares on issue.

The company seemed to be backed into a corner despite reasonably high coal prices and strong production, they have been struggling to sell coal because of logistical issues – around ~$100m in coal is sitting in stockpiles with rail and shipping both facing delays. Essentially the company needed cash to continue with the buildout of the Burton mine complex and processing plant. We had previously seen these projects as funded through cashflows given the company has producing assets.

Shares briefly traded below the 17cps raise price yesterday, ultimately closing at that level, though there did appear to be keen buyers into the weakness.