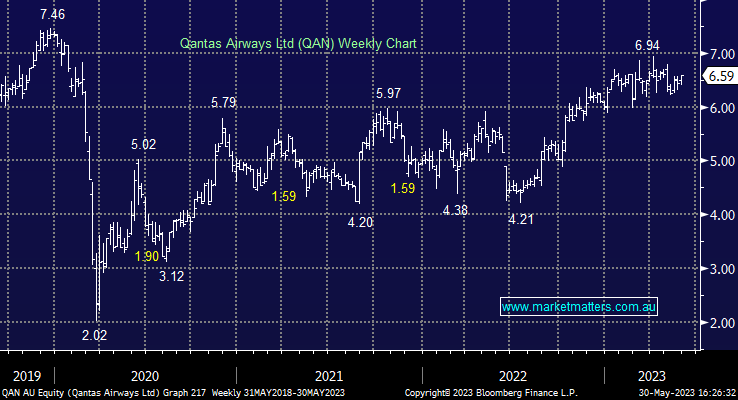

QAN +2.65%: the flying kangaroo hosted an investor day today to set the scene for the next few years as they prepare for the exit of CEO Alan Joyce. Qantas has exited the COVID disruption as a leaner business with better margins, aiming for 18% in the domestic business vs ~13% in FY19. The International business is expected to jump from mid-single digits in FY17-19 to the low double digits (10-12% targeted in the medium term), while Jetstar is expected to return to the ~15% pre-COVID margins from FY24. Their loyalty business is on track to hit $425-450m in EBIT this year, up ~15% on FY19, before doubling by FY30. Trading on ~6.5x PE, it is well below the long-term average given fears around a significant near-term CAPEX spend to revitalize its fleet and lounges, however, today’s presentation allayed some of those fears, continuing to target 2-2.5x Net Debt to EBITDA with FY24 CAPEX guidance of $3-3.2b. Key to their execution will be reducing costs in line with the expected normalization of airfare prices.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM is neutral QAN

Add To Hit List

Related Q&A

MM’s view on tourism stocks

Is Qantas turning around ?

Does MM plan to buy Qantas shares (QAN)?

Does MM like the AIZ rights issue?

MM views on Qantas (QAN) & Kogan (KGN)

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.