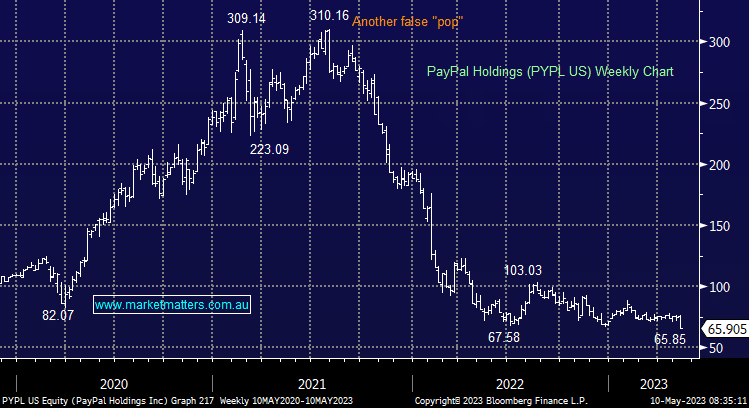

US-based payments company, Paypal reported quarterly results after the market yesterday, and at the high level, they looked solid with total payment volume of $US354.51bn for the quarter, up 9.8% yoy and above expectations producing revenue of $7.04bn which was up 8.6%. However, there were disappointing aspects to the update that imply ongoing weakness is likely. They grew payment volumes well, and earnings were up, however, the delta between the increase in volumes and the uptick in earnings was disappointing i.e. volumes beat by ~3% while earnings beat by ~1%. This tells us that margins are an issue and to that end, they lowered their operating margin expansion outlook from 125bps to 100bps.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM is likely to cut PYPL from the International Equities Portfolio

Add To Hit List

Related Q&A

How does MM rate PayPal (PYPL US) & Metrics Master Income Trust (MXT)?

Does MM like PayPal Holdings after its recent plunge?

What’s ideal US equities Exposure?

Is PYPL still expensive?

Virgin Money (VUK), Whitehaven (WHC) & Paypal (PYPL US)

Is The Trade Desk and Paypal considered tech?

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.