What Matters Today in Markets: Listen Here each morning

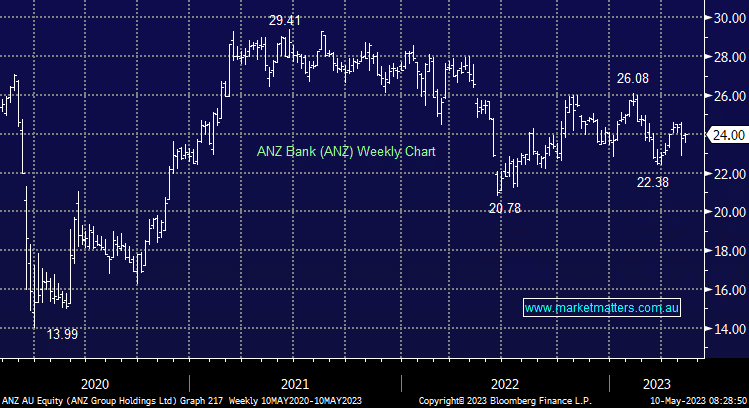

A quiet session for the ASX200 yesterday with weakness among the Property & IT sectors offset by some bargain hunting amongst the Financials as results inspired weakness restored better value in the banks. Since NAB kicked off bank reporting this time last week, ANZ has been the best relative performer down just -0.12%, followed by Commonwealth Bank (CBA) which has slid -0.95% following a quarterly trading update, Westpac (WBC) is off -1.75%, while a -4.1% decline from National Australia Bank (NAB) gave it the unwanted mantle as ‘the weakest link’. While earnings were strong as margins expanded, they were up less than expected which was a consistent theme across the ‘Big 4’ as competition for mortgages and deposits eroded some of the margin benefits from higher interest rates. Capital positions remain incredibly strong with banks carrying an extraordinarily high buffer for future economic challenges while there was very little sign of stress amongst customers.

6 months ago, analysts were forecasting earnings growth in the sector of around 13.5% for FY23, today that number sits above 16.5% although it did peak at 17% around a month ago. This means there has been no material downgrades to this year’s earnings, however, we are seeing downgrades to expectations for next year (FY24) where analysts now expect earnings to decline by an average of 6%, top and tailed by CBA where consensus is pricing in a 4.7% reduction versus NAB which is being forecast to see earnings fall by 8.5%.

- Balancing valuation with the recent update, ANZ comes out as our preferred pick in the sector.

The Federal Budget that was released by Treasurer Jim Chalmers overnight, Labor’s first surplus since Bob Hawke was Prime Minister back in 1989. Higher commodity prices, low unemployment and higher wages mean the Government’s income is set to exceed its expenditure over FY24, not by a lot ($4.3bn) but it’s a forecasted surplus nonetheless. Peter Costello was the last Treasurer to announce such a result back in 2008/9, the main difference being that the positive outcomes were predicted for the next 3 years while last night Jim Chalmers sighted a more fleeting event, with deficits likely to resume in FY25.

Budgets don’t generally have a significant impact on financial markets, in the near term at least, and while we all try and find the winners and losers in last night’s missive, the influences are often more nuanced and can be fleeting at best. At a macro level, the elephant in the room is inflation and it was important that Dr Chalmers & co did not unnecessarily stoke demand and make the RBA’s already unenviable job more difficult. We don’t think they did, although their optimistic forecast that we’d see the end of runaway inflation effectively by the time of the election, seems politically convenient.

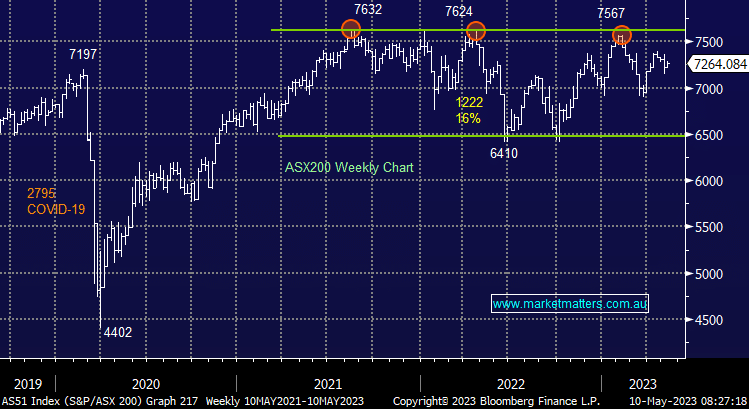

While markets are showing resilience in the face of multiple economic challenges, we remain more neutral at the index level with a clear preference for backing individual stocks, while incrementally reducing the ‘beta’ in our portfolios. Essentially, that just means turning slightly more defensive overall given the strong advance we’ve captured across the Market Matters Portfolios this FY as equities look and feel a little nervous as we trade deeper into the seasonally weak “sell in May & go away” period.