Hi Sidney,

CBA does not have any of their existing Hybrids due until next year, plus they have just done a big bond deal (wholesale), so unlikely in our view until at least August or September at the earliest. They may surprise us, however we’re not hearing of any looming new PERLS issue. If/when they launch a new deal, these are only available through syndicate brokers.

Most major bank hybrids rank equally in the capital structure – these are referred to as Tier 1 securities which add to a banks tier 1 capital ratios. NAB does have a subordinated note on issue (NABPE) which is slightly different, and this sits higher in the capital structure than Tier 1 hybrids which means it is safer , all things being equal.

Yes, bank Hybrids sit above bank equity in the capital structure, however, in times of severe stress, tier 1 hybrids can convert to equity. This is unlikely and therefore, we view hybrids as a lower risk security versus equity.

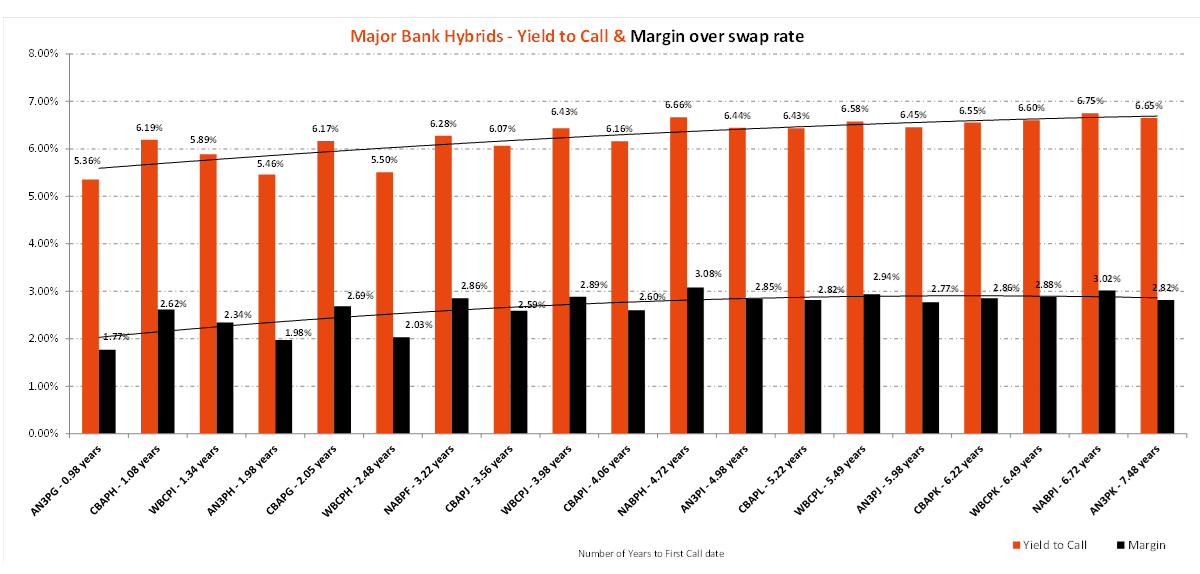

Current screen brings up the following:

Relatively Cheap:

< 3 year: CBAPH, CBAPG

3-5 year: WBCPJ, NABPH

> 5 year: WBCPL, NABPI

Relatively Expensive:

AN3PH, WBCPH

The USTB is the US Treasury Bond ETF. US Treasuries would be considered safer than bank hybrids in a general sense and they offer a lower yield as a consequence. The average coupon on these holdings is currently ~2%. The other obvious difference is that Treasuries are fixed rate in nature while Hybrids are floating.