What Matters Today in Markets: Listen Here each morning

The ASX200 fell -0.8% yesterday under the weight of an extremely hawkish Senate testimony from Fed Chair Jerome Powell, over the last 24 hours we have seen the RBA and Fed pull in completely opposite directions – encouragingly for Australia’s economy Philip Lowe adopted a more dovish stance after 10 consecutive rate hikes but it’s a big ask for the Australian central bank to ignore moves from Jerome Powell et al:

- Philip Lowe is implying the RBA might even refrain from hiking rates next month to assess the impact that the new level of 3.6% will have on local inflation – he must have read the MM report over the last week!

- Conversely Jerome Powell warned markets that interest rates are set to move higher than previously expected i.e. the Fed might take rates up towards 6% which MM doesn’t believe equities are fully factoring into their valuations.

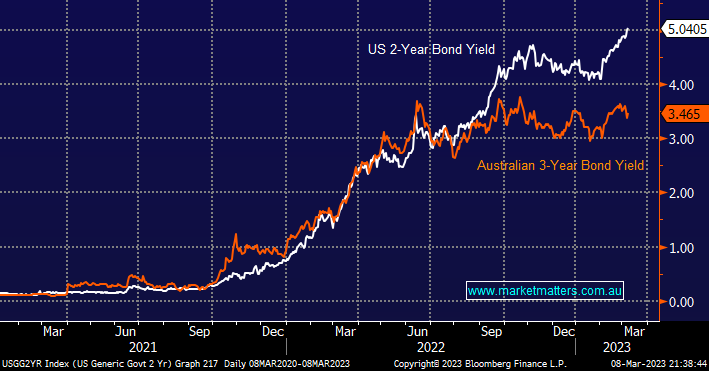

We believe the short-dated bond yields from both countries have been calling this divergence perfectly for the last 6 months and MM doesn’t see any reason to fade the currently expanding 1.5% differential in yield with a target closer to 2% feeling likely under the current barrage of diverse rhetoric.

- We believe the Fed will hike rates into the 5.6%-6% region with the lower of these two where markets currently expect a top i.e. risk is on the upside.

- Conversely we believe that RBA will not take the local Cash Rate above 3.85% – we are more dovish than most.

Yesterday’s stock market fall was broad based with over 70% of the index closing down on the day, there were no standout pockets of strength with the few winners spread across most sectors. We now have reporting season, the RBA & Fed in the rear-view mirror hence the next week should show us if equities can move to a new level of equilibrium, the index is starting to feel comfortable in the 7200-7400 region. On balance we are bullish but as we witnessed yesterday some of the recent gains are fragile in nature.

US stocks had another mixed session overnight with the interest rate-sensitive Real Estate and Tech two of the best performers, the Dow finished down -58 points while the tech-based NASDAQ rallied +0.5% i.e. no follow-through selling after Jerome Powel’s hawkish comments yesterday. The SPI Futures are pointing to a +0.4% gain early this morning helped by a 35c bounce by BHP.