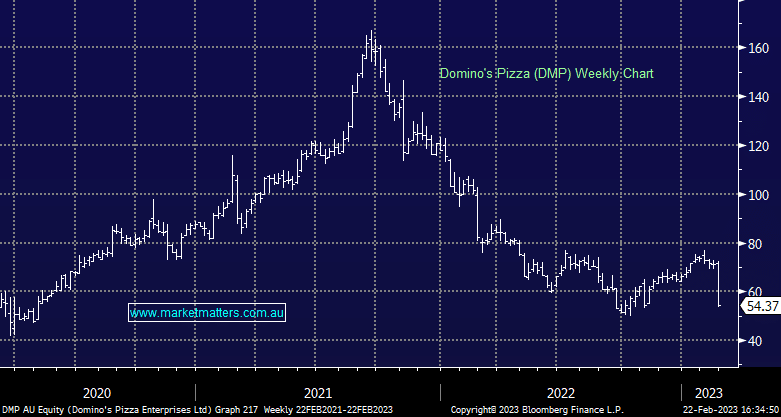

DMP -23.81%: Whacked today and rightly so after a result that was a big miss to consensus while market positioning had clearly become more positive on the stock with the share price up ~50% from its recent lows. Fund manager’s drank the DMP cool-aid with gusto as Mr Meji said that while things were tough, they were turning around – which now seems a stretch, in the short term at least. For the 1H, same-store sales growth was -0.55%, online sales went backwards (-4.5%), and revenue declined (-4.3%). With a weaker top line and rising cost pressures, earnings fell by more with underlying EBIT of $113.9m down 21% YoY while net profit was around ~16% below consensus. A stock on ~30x earnings that is not growing is a stock that won’t be on 30x for long, and that was certainly the case with DMP today. We have no interest in trying to catch this falling knife – downgrades to come.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM continues to have no interest in DMP

Add To Hit List

Related Q&A

Broker price targets

Turnaround Opportunities

DMP/CKF as possible growth/dividend stocks

DMP & Chemist Warehouse

Does MM like Dominos (DMP) capital raise?

Does MM like CKF &/or DMP?

What are MM’s thoughts on Domino Pizza?

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.