Hi Andrew,

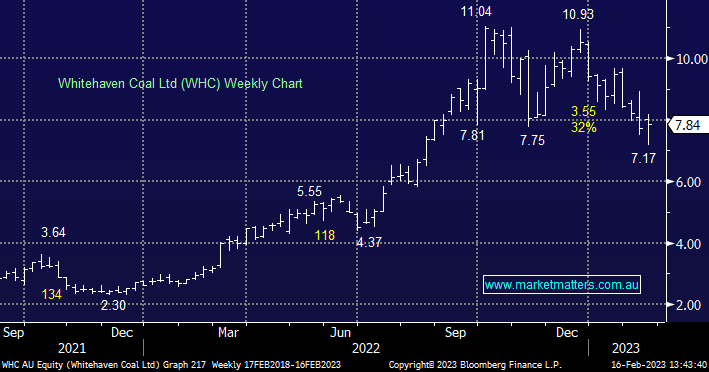

Thanks, an excellent question, especially for new MM members. When we send out an alert we will buy or sell within around 1% of the price mentioned within the alert, in the case of WHC, the last ¬1% we bought in WHC was filled around $7.80, however our average price of our total position (shown in the portfolio) is actually $8.18, given we bought our first tranche of this holding at higher levels.

A couple of important points to note as we run real money portfolios:

- If we are unable to get set as the stock has traded too far away from our entry/exit price we will either send a follow up alert to trade at a different price or simply not get set and then discuss our thoughts in the PM Report.

In terms of the timeframe, we do mention 2 things in the portfolio:

- If the stock is held in one of our portfolios and the view is ‘active’, we are still buyers at today’s price.

- we do also mention the time horizon and perceived degree of risk as you move across to the RHS of portfolios.

Markets evolve and so to do our views, hence our use of real-time trading alerts via email & SMS (for the growth portfolio).

NB: If we can stress one further thing, it is about position size. Yes, we are bullish on coal equities, however our portfolio allocation is 4% in 2 separate portfolios, and we would not increase above 5% given these are high risk positions and are marked as such in the portfolio’s. If we are wrong and coal equities continue to remain weak, and our current loss of ¬7% on each position increases, it will remain manageable.

Flagship Growth Portfolio – Market Matters